Get Your Rent Receipts Now!

Avoid the last minute hassle of arranging your rent receipts for claiming HRA exemption. Use our free rent receipt generator and save taxes. It is fast, convenient and easy.

Avoid the last minute hassle of arranging your rent receipts for claiming HRA exemption. Use our free rent receipt generator and save taxes. It is fast, convenient and easy.

Option to generate rent receipt printable online - Monthly, Quarterly, Half-Yearly and Yearly

For claiming HRA exemptions it is mandatory to submit Rent Receipts to the employer

This can be done in just 4 simple steps

Generate rent receipt by filling in the required details

Print the receipt

Get the receipt stamped & signed by landlord

Submit Rent Receipts to your employer

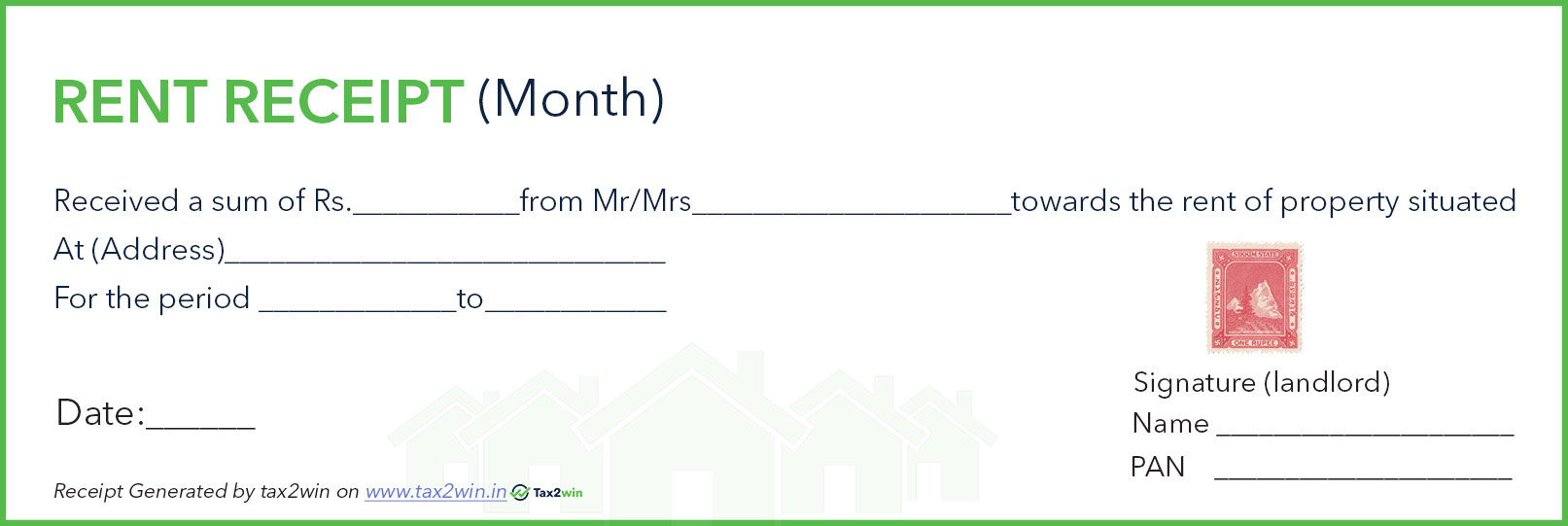

Sample Rent Receipt Template Format

Rent receipt is an important document which is used as a proof of the rent paid to the landlord. It is a key instrument for tax saving and so should be collected and kept safely. Salaried employees need rent receipts to claim their House Rent Allowance (HRA).

For claiming HRA exemptions it is mandatory to submit Rent Receipts to the employer

This can be done in just 3 simple steps

Enter amount of rent paid and address

Fill details of self and landlord

Select Period for which you want to generate rent receipt

(Monthly, Quarterly, Annually)

The following are the details which are required in the rent receipt:

Tenant Name (If you are the tenant, fill in your name)

Landlord Name.

Amount of Payment.

Date of Payment.

Rental Period.

House Address (Rented Property)

Signature of Landlord or Manager.

A revenue stamp is required to be affixed on rent receipts if cash payment is more than Rs. 5000 per receipt. If rent is paid through cheque then revenue stamp is not required.

You can easily understand it from the given table

| Mode of Payment | Whether revenue stamp is required |

|---|---|

| Cash, upto 5000 per receipt | No |

| Cash, more than 5000 per receipt | Yes |

| Cheque | No |

The amount of tax saving on rent is equal to amount of HRA (House Rent Allowance) exemption you are eligible to claim.

To calculate your HRA exemption use our free calculator or Read more.

Ans. If an employee receives HRA in excess of Rs. 3000/- per month, it is mandatory to provide Rent receipt to employer as an evidence for claiming HRA.

Even if your HRA is less than Rs. 3000/-, try to keep rent receipts with you in case the Income Tax Officer asks for them at a later date.

Ans. Generally employers ask for rent receipts for 3-4 months.

Ans. While generating rent receipts online in the third step when you select the period you can make a choice of generating rent receipts yearly, monthly or quarterly for the specified time period.

Ans. No, You will get printable rent receipts without revenue stamps. You can always get revenue stamps and affix the same if required.

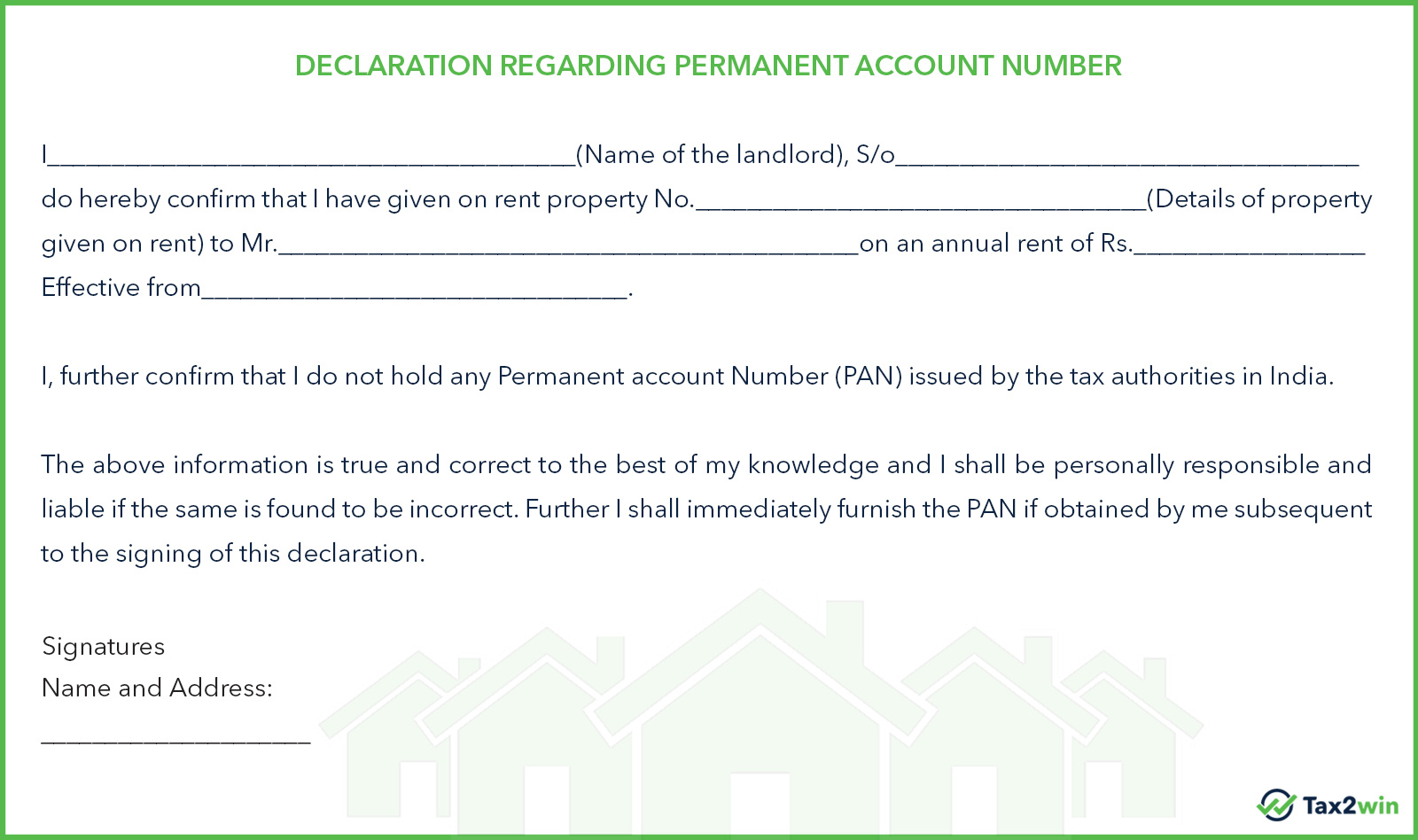

Ans. PAN of landlord is required only if rent exceeds Rs.8333/- per month (Rs.100000/- annually). In case the landlord does not have PAN, declaration of the same is required. Download Declaration Form

If the landlord does not provide his PAN, you can obtain the same from the below mentioned link. (know your PAN)

Sample Declaration Form

Ans. The only evidence required for claiming HRA is the Rent receipt issued by the landlord.

Ans. No, there is no need for the same. Only PAN No is required to mention on rent receipt.

Ans. The reason behind declaring a landlord's PAN is to track fake receipts being submitted by employees to claim HRA.

Ans. Even if you forgot to submit rent receipts, you are eligible to claim HRA while filing IT return. All you need is Rent receipts and PAN of landlord in case annual rent exceeds Rs.100000/-

Our experts are here to help you claim all the available tax exemptions and deductions & file your IT return in a hassle-free manner. Connect Now to know how!