Most of the employees face difficulties in understanding the purpose of rent receipts or how to properly utilize them for tax benefits and sometimes even make the fake receipts to avail the tax benefits. Since providing these rent receipts to accounts department or HR department has become a ritual that we perform once a year, but we never bothered to get in-depth understanding of rent receipts. Whatever the situation be, we are addressing all your concerns in this guide to make sure you never face difficulties on rent receipts after reading this guide.

Why rent receipts are required?

To claim House rent allowance (HRA), it is necessary to provide evidence of the payment of the rent to the employer, rent receipts works as an evidence. The employer can provide deductions and allowances after verifying the same. The HRA allowance is based on the rent receipts and will be calculated accordingly.

So, What are rent receipts exactly?

Well, this is not a weird question to ask but a relevant & important question. One should have understanding of rent receipt in terms of logic and its economics. A rent receipt is a proof of transaction of rent paid by a tenant to his/her landlord. Rent receipt(document) is provided by the landlord upon receiving the rent from rentee and his signatures are placed on the it. If you have received the rent receipt, you should keep them with the documents you care about. Rent receipts can be used for legal matters( in case any) or tax benefits if you are eligible.

What are the elements of a rent receipt?

We can understand the elements of rent receipt by following statement:

“The transaction of rent happens between tenant & landlord on certain date each month for a premise having an address and rent of xxx amount for the period of a month.”

- Tenant Name (If you are the tenant, fill in your name)

- Landlord Name

- Amount of Payment

- Date of Payment

- Rental Period

- House Address (Rented Property)

- Signature of Landlord or Manager

- PAN of the Landlord(not mandatory, mention only if annual rent exceeds Rs.1,00,000 in a year)

- Revenue Stamp(where amount exceeding Rs. 5000 is paid in cash)

- Method of payment (cash, credit card, money order, cashier’s check)

- Services or other fees included in the payment (e.g. utilities, security deposits, convenience fees)

If you are still confused on these details and would like to generate a rent receipt online: CLICK TO GENERATE RENT RECEIPTS

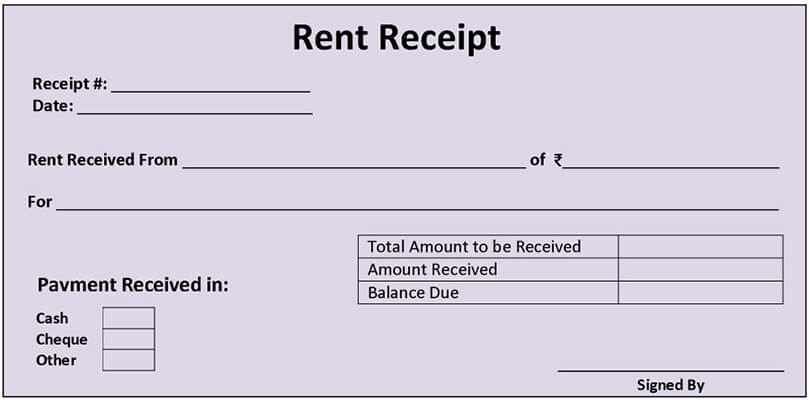

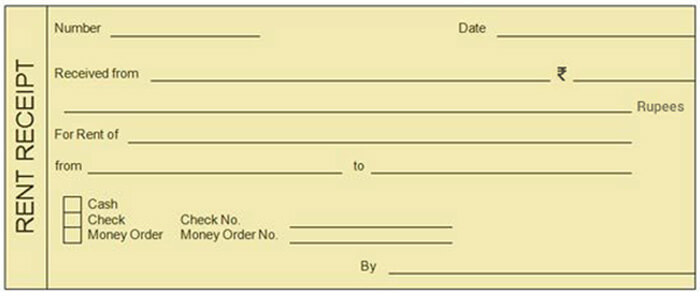

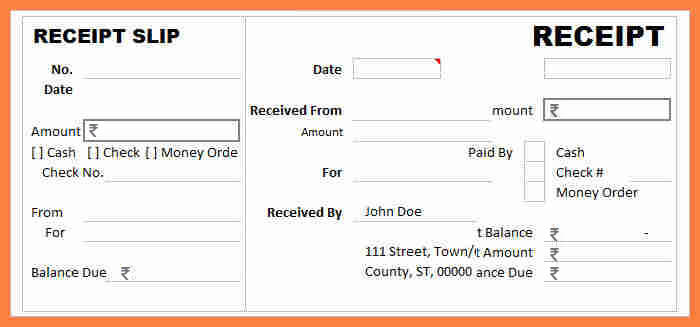

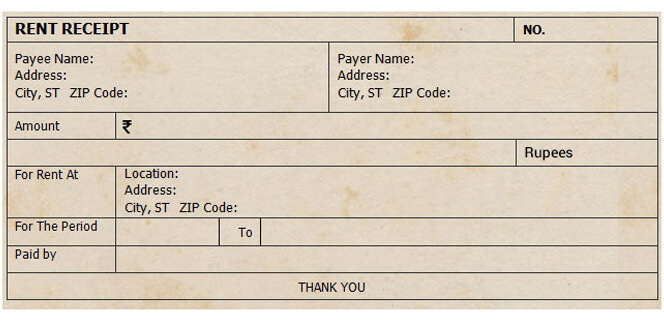

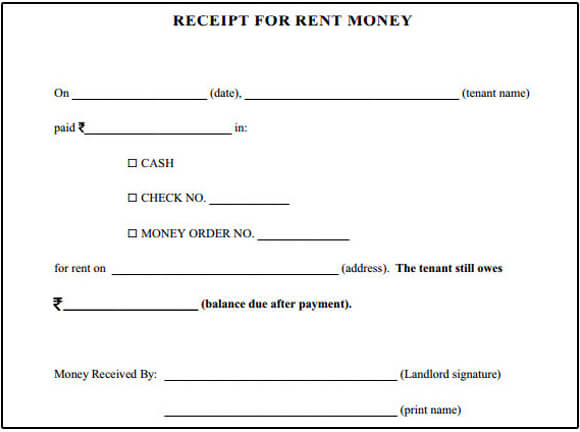

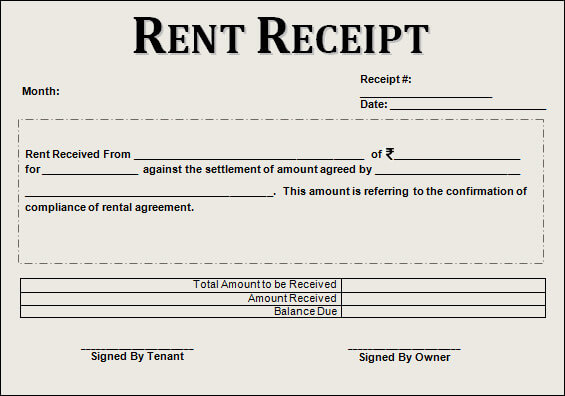

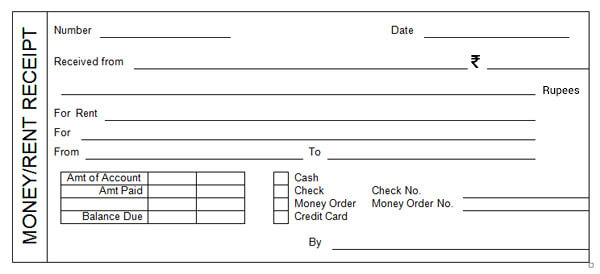

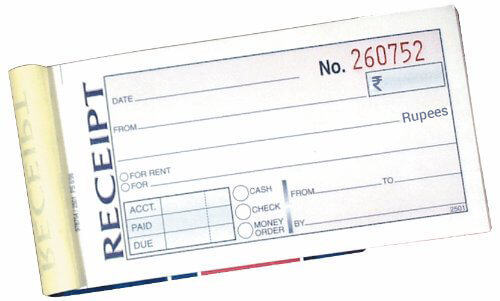

Some examples/formats of rent receipts being used in India:

India being a vast country having multiple languages, methods to document transactions, and different formats used by receipt books publishers, we have many formats/designs available in market. Professionals/Employees often gets confused due to these different formats available.

We are presenting you some of the formats we have found in India to help you understand that they are all same & serve the same purpose

Rent slip format:

For the convenience of our users, we are providing a facility to customise and download free printable rent receipts(valid format) from our rent receipt generator tool.

CLICK TO GENERATE RENT RECEIPTS

Now comes the question , what is the actual benefit of Rent Receipts ?

Many companies provide House Rent Allowance(HRA) to employees for meeting the cost of living in a rented accommodation. HRA is one of the biggest tax saving avenue as the complete amount of HRA is not taxable.

The least of the three amounts is tax exempt -- Actual HRA received

- Rent paid less 10% of Salary

- 40% of Salary (50% of Salary in Mumbai, Delhi, Chennai and Kolkata)

In order to give you the benefit of HRA, the HR department needs to verify whether you have actually paid rent for allowing HRA tax exemption.

Rent receipts act as a proof that you have actually paid the amount and not showing any fake expenses to save tax.

Is rent receipt mandatory for claiming HRA?

-

If employee receives HRA in excess of Rs. 3000/- per month, it is mandatory to provide Rent receipt to employer as an evidence for claiming HRA.

-

Even if your HRA is less than Rs. 3000/-, try to keep rent receipts with you in case Income Tax Officer asks for them at a later date.

I am sure you would agree with me when I say the landlords do not give the rent receipts even after paying the rent. So, what do we do in this situation ?

Simple just give the filled rent receipts to your landlord and ask him to sign them to acknowledge the receipt of rent.

Where to get the rent receipts from to be submitted to the HR department?

There is no set format for the rent receipts for claiming the HRA exemption. Here’s the hack for getting one for yourself-

-

Search the web and choose the one you like from the options available. Like https://filemytaxonline.com/tax-tools/rent-receipt

-

Buy a rent receipt booklet from the stationery

Why I am required to submit rent receipts to the HR Department?

As per the Income Tax law of our country every person who pays salary is required to deduct tax at source(TDS) , deposit with the government and then pay remaining amount to the employee. During this process if any employee makes a tax saving expenditure then the person responsible for deducting tax, has to consider and give benefit of that expenditure and then deduct the tax on the net amount.

Practically, it has been observed that people submit fake rent receipts, even when they are not living in a rented accommodation. So, to counter this, HR departments have started asking for rent agreements for giving HRA benefits.

Looking at the importance of rent agreements, here are 5 things to check in your rent agreementSmart tactics to be followed at the time of drafting rent agreements-

-

Rent agreement should be on Rs. 500 stamp or as per the stamp rate prevailing in your state .

-

It can be entered into for 11 months only.

-

For more than 12 months, the rent agreement is not entered into instead lease deed is to be preferred which needs registration.

-

Every year, the rent agreement is renewed after 11 months with the increased rent.

-

Both landlord and tenant are required to serve the notice period as stated in agreement.

Important things to note about the rent receipts:

-

A revenue stamp is required to be affixed on rent receipts if cash payment is more than Rs. 5000 per receipt. If rent is paid through cheque then revenue stamp is not required.

-

The rent receipts for all the months for which you are claiming HRA is required to be submitted.

-

If the annual rent paid exceeds Rs.1,00,000/- it is mandatory to report PAN of the landlord to claim HRA exemption.If landlord refuses to give his PAN, then you cannot claim HRA for the rent paid in excess of Rs. 1,00,000/- and your employer will deduct the TDS accordingly.

What to do when your landlord refuses to give his PAN?

First of all my friends do not ask for the copy of the PAN Card, all you need is the PAN No. In Case, your landlord does not have a PAN card then take a declaration from him for the same and submit to your HR.

Prevention is better than cure, when taking a house on rent talk to your landlord in advance for sharing his PAN no.

Is it right to submit fake rent receipts at my office to claim HRA? Submitting a fake rent receipt can put you in trouble with Tax Department. Know more

How payment of rent helps you in saving taxes?

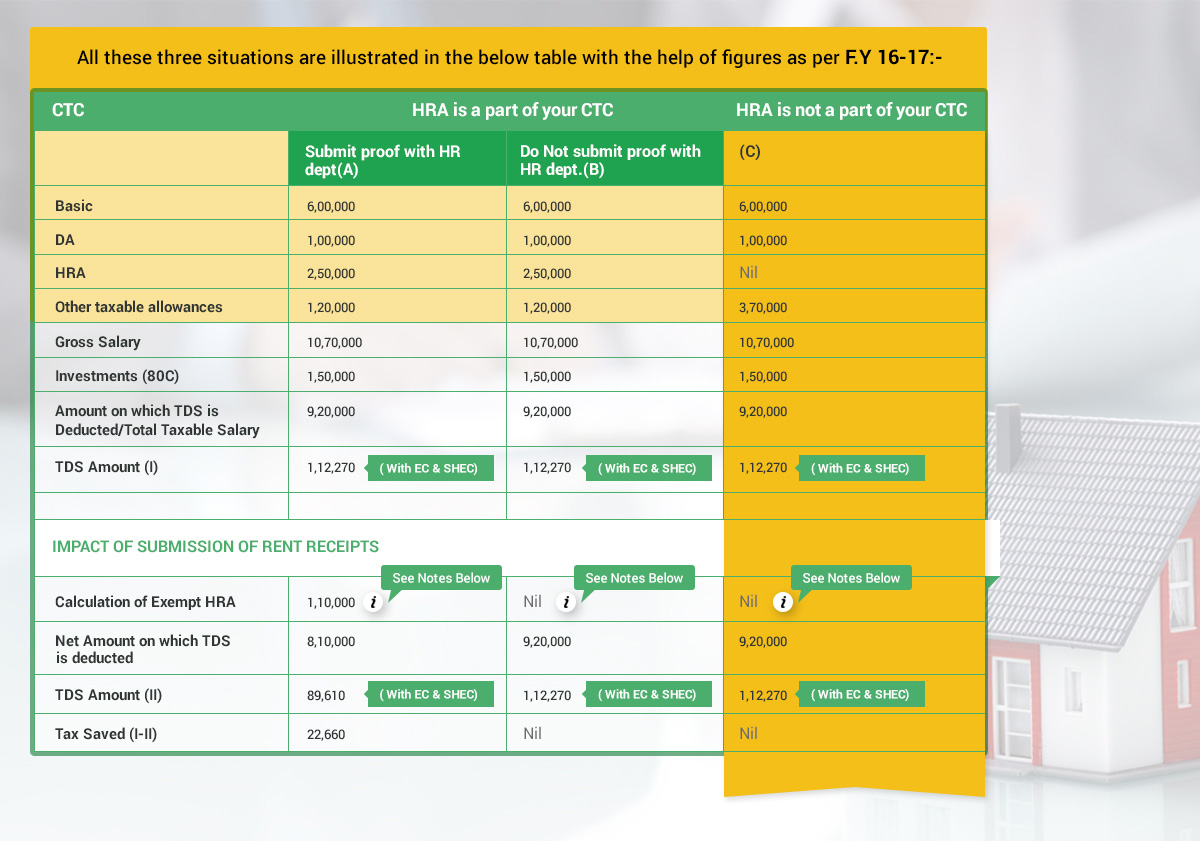

There can be three situations, when you are paying rent for the rented accommodation -

-

I.When HRA is a part of your CTC & you submit the proof of rent payment to your HR

-

Ii.When HRA is a part of your CTC & you forget to submit the proof of rent payment to your HR

-

iii.When HRA is not a part of your CTC

Notes : Condition A : Calculation of exempted HRA (Rent Paid - 1,80,000/-) :-

-

A. Actual HRA received - 2,50,000/-

-

B. Rent Paid- 10% of Basic +DA= {180000- (700000*10%)}=110000/-

-

C. 50% of Basic + DA ( 700000*50%)= 350000/=

A, B,C whichever is lower is to be selected as exempted HRA.

Condition B : You can still claim the tax benefit of HRA at the time of filing of return as HRA is a part of your CTC.The only notional loss you will have to bear is more amount of TDS will be deducted during the year.

Condition C : If HRA is not a part of your CTC , don’t be disheartened. You can still claim the deduction of rent paid at the time of filing return u/s 80GG but upto Rs. 60,000 only.

What if I forgot to submit rent receipts at the time of declaration?

Even if you forgot to submit rent receipts, you can still claim HRA while filing IT return. All you need is Rent receipts only.

How to claim HRA exemption at the time of filing the ITR?

Here is a step-by step process for claiming HRA exemption-

-

Step 1: Calculate the HRA exemption amount as discussed above. To avoid hassle you can also use our HRA exemption calculator to find out the amount of exempt HRA at https://filemytaxonline.com/tax-tools/hra-calculator

-

Step2 : Deduct the amount of exempt HRA from the Income Chargeable under the head salary [column 6 of your Form 16, Part B].

-

Step3: Enter the amount calculated in Step 2 under Income From Salary /Pension. For instance your Gross Salary from Form 16 is 8,00,000 and you have HRA exemption of Rs. 1,20,000, So instead of showing Salary income Rs. 8,00,000/- in ITR1 fill it as 6,80,000/-.

Who can claim HRA exemption ?

If you satisfy these conditions, you can claim HRA tax exemption:

- 1. You are a salaried employee.

- 2. You receive HRA as a part of your salary package/CTC.

- 3. You live in a rented accommodation.

How HRA is exempt for income tax?

Although HRA is a part of the salary, but unlike basic salary it is not fully taxable. A part of HRA gets exempted under Section 10 (13A) of the Income-tax Act, subjected to certain conditions. The amount of exempted HRA is deductible from the total income before arriving at a taxable income.

Can I pay rent to my parents and claim HRA?

Yes, you can claim HRA tax exemption by paying rent to your parents. It is advisable to have a rent agreement. You would need rent receipts to claim HRA exemption. Also, your parents need to show rental income from you in their income tax return.

Can I claim HRA and home loan?

Yes, certainly. You can claim both. If you are staying in a rented house, then you are eligible to claim HRA tax exemption. Simultaneously, if you have taken a house loan then you can claim the house loan benefits too. If you have bought a house with the help of a home loan and live in another house on rent, you can claim tax benefit for both. But if the house you bought and the house you live in are in the same city, you should have a genuine reason for not living in the house that you own, to prove to Income Tax Officer. The reasons could be that the house you own is too far from your workplace, or the commute is very difficult.

Can HRA be claimed if I own a house?

No, you cannot enjoy the tax benefits of HRA if you live in your own house. One cannot pay rent to oneself. Hence, no exemption is available for HRA and the whole of HRA received becomes taxable under “Income from Salary”. But if you reside in a rented property, then you can claim exemption even if you own a house (in the same city or in a different city).

Can HRA be claimed for paying rent for 2 houses?

This could be possible only when you live in both the houses in a particular year for proportionate months.

How LTA is Calculated?

- In case of LTA , the employer reimburses the travel expenses for the vacation taken by an employee. However, any other expense such as food, shopping, lodging etc. is not included in the exemption. Available for only two children of an individual, born after October 1st, 1998 including a step or adopted child.

- Travelling Twice in a block of Four years is allowed. The current block is 2014-17.

- Mode of travel should be air, rail or any other public mode of transport.

- Allowed for domestic travels and not for international travels.

Can husband pay rent to wife and claim HRA?

Normally, Tax benefit of HRA cannot be claimed by paying rent to your spouse. So, if you are staying in a house owned by your spouse then HRA exemptions are not available to you. However, if you still wish to claim exemption, you should be ready for litigation as Income Tax Officer might have different view.

Can HRA be claimed by both husband and wife?

Yes, why not, provided both are paying rent. Also, it will be better if the landlord issues two separate rent receipts or specifies the proportion of rent borne by each person on the rent receipt.

Can I use my electric bill as a tax deduction?

There is no tax deduction in respect of electricity bill. However, if you are in business then you can claim the same as your business expense.

What is section 10 exemption?

Sec 10 includes those incomes which do not form part of total income i.e. exempt income. Like agriculture income, specified interest income, Dividend Income etc.

What is HRA deduction?

HRA or House Rent Allowance is an allowance which salaried individuals receive from their employer for meeting the rental expenses of their house. The amount received is partly exempted from tax, for the employee who are residing in a rented house. In case the employee lives in his/her own house and does not pay any rent, the entire amount would be taxable.

Frequently Asked Questions

Q- Me and my family are living in two different cities and rent for both the houses are paid by me. Can I claim HRA exemption for both the house rents paid?

Ans. As per Section 10(13A) of the Income Tax Act, 1961 exemption of House Rent Allowance is available to the employee for the rent paid in respect of the property which is occupied by himself. Hence, rent paid for the house where your family is living cannot be claimed as an exemption in this case.

Q- How can I claim HRA deduction of previous employer which company has not mentioned in Form-16 but HRA is part of salary?

Ans. Even if employer fails to provide HRA exemption benefits of previous employer and deducted higher tax as TDS, the assessee can still avail benefit of HRA exemption at the time of filing of return and claim a refund of such excess tax deducted.

Q- Is it safe for me to give out multiple rent receipts to my tenant?

Ans. If you give multiple receipts, on papers with different serial numbers or on a statement that doesn't show the balance before and after the payment was received, then you're asking for trouble as it could be claimed that they gave you an extra payment and you may be asked by tax department to include that in your income.

Q- How can I claim HRA exemption paid in another state than the state you work in?

Ans. If you are receiving HRA in one state, being the state in which you are working, then you cannot claim the exemption for payment of rent in another state. You can only claim the rent paid in the city of employment for claim of HRA.

Q- What is the solution if I have submitted rent receipt without revenue stamp?

Ans. Stamp needs to be affixed on receipts if payment is made in cash more than Rs. 5000. Revenue stamp on a rent receipt makes it a legal document, it means that payment has been received by the recipient and paid by payer.

Q- I am living in a shared flat with my friend. How can I get HRA exemptions without affecting my sharing friend with the same rent agreement?

Ans. HRA can be claimed by you and your friend in the same proportion of rent payment.

Q- Is it right for me to submit fake rental receipts at my office, to avoid tax? Does the Indian state/central govt ever track these fake receipts?

Ans. Yes, Income tax department can track your details as Form 16 is in sync with the ITR form, which will help the Income Tax Department in electronically matching the data reported in ITR.

Q- Is it right to submit a rent receipt with the PAN number of another person’s name and the person don't do earning for tax benefits?

Ans.No, rent receipt should have PAN of the person who has paid the rent and not of anybody else.

Q- Does HRA fall under 80C category?

Ans. No, HRA should be deducted from total Taxable Salary.

Q- Can I claim both home loan tax benefit and HRA benefit?

Ans.Yes, You can claim both HRA exemption and home loan benefits. The fact is that you should actually be paying rent f.Both HRA and home loan benefits are governed by different sections.

Q- How do I claim HRA if my employer is not paying me the same?

Ans. If you are not getting the benefit of House Rent Allowance and you have not claimed any of expense for rent paid under any other section of the income tax act, then you can claim a deduction under Section 80GG.

Points to Remember: For claiming HRA exemption you need to submit the rent receipts as a proof of rent payment to your HR/Accounts department.

There is no set format for rent receipts prescribed.

If paying rent more than Rs. 5000 in cash then ensure the revenue receipt is affixed with the revenue stamp.

If the annual payment of rent exceeds 100000, then you need to report the PAN No of your landlord.

If you forgot to submit the rent receipts at the time of proof declaration you can still claim the benefit of HRA exemption at the time of filing your Income Tax Return (ITR).

- Income Tax Slab & Tax Rates for FY 2020-21(AY 2021-22) & FY 2019-20 (AY 2020-21)

- Income Tax Return (ITR) Filing FY 2020-21: How to File ITR Online India

- Form 16: What is Form 16? Form 16 Meaning, Format & How to Upload

- Tax Benefits on Housing Loans for Home Buyers

- Section 234F: Penalty for Late Filing of Income Tax Return