What is the meaning of Section 234F?

In Budget 2017 our honorable Finance Minister, Mr. Arun Jaitley introduced a new section 234F to ensure timely filing of income tax returns. As per section 234F of Income Tax Act, if a person is required to an file Income Tax Return (ITR forms) as per the provisions the of Income Tax Law [section 139(1)] but does not file it within the prescribed time limit then late fees have to be deposited by him while filing his ITR form. The quantum of fees shall depend upon the time of filing the return and the total income.

When is a person mandatorily required to file Income Tax Return?

If you fall in the below conditions then you have to mandatorily file your income tax return:

- If the gross total income (before allowing any deductions under section 80C to 80U) exceeds the basic exemption limit i.e. Rs.2,50,000 (for individuals below 60 years) or Rs. 3,00,000 (for individuals of 60 years and above but less than 80 years old) or Rs. 5,00,000 (for individuals of 80 years and above) as the case may be.

- If you hold any asset including financial interest in any entity located outside India OR has signing authority in any account located outside India as a beneficial owner or otherwise.

- If you are a beneficiary of any asset located outside India.

Basic exemption limit is the maximum threshold amount up to which your income is not chargeable to tax. In simple words, if your income exceeds the basic exemption limit then you are mandatorily required to file the return. Currently, it is Rs.2,50,000 (for individuals below 60 years) or Rs. 3,00,000 (for individuals of 60 years and above but less than 80 years) or Rs. 5,00,000 (for individuals of 80 years and above) as the case may be

- incurred expenses on payment of electricity for Rs.1 lakh or more during the year.

- incurred an expenses of Rs.2 lakhs or more for foreign travel, either for himself or another person.

- deposited Rs.1 Cr or more in the current accounts maintained with a banking company or a co-operative bank.

What are the prescribed time limits (Due Dates) for filing ITR?

The due dates for filing Income Tax Return under section 139(1) of Income Tax Act for different categories of taxpayers are as under :

| Category | Due date of filing (FY 2018-19) | Due date of filing (FY 2019-20) |

|---|---|---|

| Individuals who are not required to be audited | 31st July 2019 (extended to 31st August) | 31st July 2020 (extended to 30th Nov 2020) |

| Company or Individual whose accounts are required to be audited | 30th Sep 2019 (extended to 31st October) | 31th Oct 2020 (extended to 30th Nov 2020) |

| Individual who is required to furnish report referred in section 92E | 30th November | 30th November 2020 |

Who will be covered under the scope of 234F?

All persons including Individual, HUF, Company, Firm, AOP etc. will be covered under the scope of Section 234F of Income Tax Act 1961. All persons will be liable to pay late filing fees, when the Income Tax Return is filed after their respective due dates.

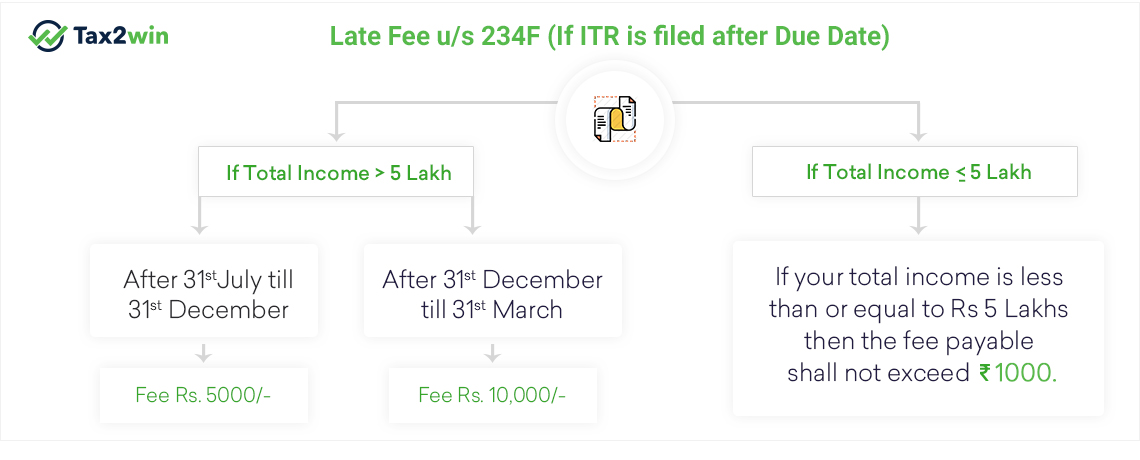

What is the amount of fees that can be levied under 234F by the Income Tax?

The quantum of fees that can be levied under section 234F of income tax act 1961 for FY 2018-19(AY 2019-20) filing is as under :

(i) If the return is furnished after 31st August but on or before the 31st day of December of the assessment year - Rs. 5000 (i.e 31st August, 2019 and 31st Dec, 2019 for FY 2018-19)

(ii) If the return is furnished after 31st December of the assessment year (1 Jan - 31st March) - Rs. 10,000

- If the Total Income i.e. Income after deduction is less than or equal to five lakh rupees, then, in that case, the fee amount shall not exceed Rs. 1000.

- No penalty shall be levied in case Gross Total Income i.e. Income before deductions does not exceed maximum income not chargeable to tax i.e

Rs. 2,50,000 for normal citizen (age < 60),

Rs. 3,00,000/- for senior citizens (age 60 or above) and

Rs. 5,00,000/- for super senior citizens ( age 80 or above).

Example : A is a super senior citizen. His Gross Total Income for F.Y. 2018-19 is Rs. 4,95,000/-.He is filing a late return. Whether late filing fees be levied?

In the above case, late filing fees u/s 234F shall not be levied since A is a super senior citizen and his GTI does not exceeds basic exemption limit.

Example : 234 F Late Fees Calculation

Let’s understand the quantum of fee that would be payable under section 234 F on the following income and return filing date through an example :

| Total Income | Income Tax Return Filing Date | Fees 234F |

|---|---|---|

| 3,00,000 | 05/07/2019 | NA |

| 6,00,000 | 31/07/2019 | NA |

| 10,00,000 | 25/07/2019 | NA |

| 25,00,000 | 10/09/2019 | 5,000/- |

| 4,00,000 | 10/01/2020 | 1,000 |

| 9,00,000 | 15/10/2019 | 5,000 |

| 4,50,000 | 13/11/2019 | 1,000 |

| 18,00,000 | 15/02/2020 | 10,000 |

From which date the provisions of penalty under section 234F shall be effective?

The provisions of penalty under section 234F shall be applicable from 1 April 2018 i.e. in respect of Income Tax returns to be filed for FY 2017-18 (or AY 2018-19). In simple words, if we file the income tax return of F.Y 17-18 after 31st August 2018 then fees u/s 234F shall become operative. Financial year 17-18 was the first year when any such fees would be leviable without the intervention of Assessing Officer. Similarly if return for F.Y. 2019-20is filed after 31st July 2020, then penalty under 234F will be levied.

What was the reason for the introduction of penalty as per Section 234F?

In view of improving tax compliance, it is important that the income tax returns are filed within the due dates specified in section 139(1). Therefore, section 234F has been inserted in the Income Tax Act. Further, the reduced time limits proposed for the making of an assessment under various sections are also based on pre-requisite that returns are filed on time.

How to pay 234F Fees?

As per Finance Act 2017, Late fees under section 234F can be paid by the way of "Self Assessment"---> "Others", this penalty can be paid from FY 17-18 and onwards.

Challan No. 280

Type of payment - Self assessment (300)

Fill 234 F amount in column "Others".

Under which section shall the fees under section 234F will be paid if you have missed the deadline for filing ITR?

The fees u/s 234F shall be payable under section 140A (Self Assessment Tax). A consequential amendment has been made in section 140A to include that in case of delay in furnishing of return of income, along with the tax and interest payable, the fee for delay in furnishing of return of income shall also be payable.

What was the penalty before section 234F was introduced?

Before the introduction of sec 234F, the penalty for failure to furnish the return of income was leviable under section 271F.

As per this section, if the income tax return was not filed before the end of relevant assessment year then Assessing Officer, at its discretion may levy a penalty amounting to Rs. 5,000/- However, this section has been withdrawn from the assessment year 2018-19 and onwards after coming of penalty under section 234F into force.

How to avoid paying the fees under section 234F to the Income Tax Department?

In order to avoid payment of late fee u/s 234F, one needs to file the income tax return on time in respect of every assessment year :-) Visit File My Tax online for hassle free ITR filing.

Can the late fees u/s 234F be waived of in the genuine cases?

No, fees u/s 234F is mandatorily applicable. herefore, it cannot be waived off by income tax authority.

Can excess TDS deducted be adjusted from the fees u/s 234F?

Yes, the income tax department will adjust the excess TDS deducted (which you would have received by the way of refund) in the payment of late fees under section 234F.

Will the impact of amendment under section 234F come on the intimation under section 143(1)?

A consequential amendment in section 143(1) has been done in consonance with the introduction of sec 234F. Now, the fee payable under section 234F would also be considered in the computation of amount payable or refund due, as the case may be, on account of processing of the return.

Is 234F a fee or a penalty?

According to the Income Tax Act, the amount payable under sec 234F is termed as late fees. But,it has been observed that in common parlance, many of us are designating the amount under sec 234F as the penalty instead of fees, which is not the case. The reason being that, this fee is steeper in nature in which the assessing officer has no role in deciding its applicability. It is automatically applied after the due date.

FAQ’s on Section 234F of Income Tax

Q- What is Section 234F as per the Income Tax Act, 1961?

- As per section 234F of the Income Tax Act where a person is required to mandatorily furnish a return of income under section 139, fails to do so by the due date, attracts levy of late fee under this section to the amount of

- Rs 5,000/-, if the return is furnished on or before the 31st day of December of the assessment year;

- Rs 10,000/-, in any other case:

- In case the total income of the taxpayer does not exceed Rs 5,00,000/- then, the late fee payable shall not exceed Rs 1,000/- in any circumstances.

- Section 234F was made applicable in respect of Income Tax Return filed on or after the 1st April, 2018.

Q- If I don't file my Income Tax Return after paying all the due taxes then what would be the consequences?

Even after the payment of taxes if you don’t file your IT returns then the IT department may issue a notice of non-compliance after the end of relevant assessment year and late filing fees will be levied u/s 234F.

Q- My income is 4,50,000 and if I file my return after the due date(i.e. 31st August); then what would be the amount of fees u/s 234F which has to be paid at that time?

As per section 234F the amount of fee u/s 234F shall be Rs.1000 where income is below Rs. 5,00,000.

Hence, in your case, the quantum of fees/penalty shall be Rs. 1000 if you file between the time period 1st August to 31st March. For FY 2018-19, it's from 1st September to 31st March.

Q- My income is Rs. 6,50,000 and If I file my return for F.Y 2018-19 after the due date, say on 10th September 2019; then what would be the amount of Fees u/s 234F which is to be paid at that time?

As per section 234F, for individuals having income above Rs. 5,00,000 and filing the return before 31st December of the assessment year then the amount of fee shall be Rs.5,000. Hence, in your case, the quantum of fees leviable shall be Rs. 5,000.

Q- My income is Rs. 9,80,000 and If I file my return for F.Y 2018-19 after the due date say on 2nd January 2020; then what would be the amount of Fees u/s 234F which is to be paid at that time?

As per section 234F, for individuals having income above Rs. 5,00,000 and filing the income tax return after 31st December but before 31st March of the assessment year then the amount of fee shall be Rs.10,000. Therefore, in your case, the quantum of late fees leviable shall be Rs. 10,000.

Q- Is it possible to file the return for F.Y 17-18 after 31st March 2019 by paying the late fees of Rs.10,000 u/s 234F?

No, it is not possible to file the income tax return for F.Y 17-18 after 31st March 2019. Finance Act 2017 brought an amendment under the time limit of section 139(4), you cannot file your return after the end of relevant assessment year.

Q- If I have filed the Return but not e-verified then still penalty under section 234F would be levied?

No, as per section 234F, the penalty shall be levied on late filing of return but not on late e-verification of return.

Hence, If you e-verify after the due date of filing return but before 120 days of filing the return, fee u/s 234F cannot be levied.

Q- I have income from salary only, and the TDS is done by my employer. Will I still have to pay late fees under 234F?

Yes, fee under section 234F shall be levied even if TDS has been deducted by your employer. The reason being that fee under 234F is levied in respect of timing of return filing and not in relation to the payment of taxes.

Q- I am a retired person, have income from Bank Fixed Deposit only. TDS has already been deducted by the bank. Do I still need to pay a fee under section 234F?

Yes, fee under section 234F shall be levied even if TDS has been deducted by the bank and your total income is more than the basic exemption limit.

As fees under section 234F is levied in respect of timing of return filing and not in relation to the payment of TDS.

Q- My income is Rs. 350,000 and I am availing deduction u/s 80C of amounting Rs. 1,50,000. So, my income after deduction comes to Rs. 2,00,000 then whether section 234 F of income tax act 1961 will still be leviable in my case?

Yes, penalty under Section 234F would be leviable in your case. In your case, you are required to file ITR as per law because your income before deductions is above the basic exemption limit. Therefore, if you file the belated return then sec 234F shall be applicable. Late Fees of Rs. 1000 shall be applicable in your case.

Q- If my gross total income i.e. income before deductions is below the exemption limit then still whether i am required to deposit fee under sec 234F of income tax act 1961 on late filing?

No, if your income before deductions falls below the basic exemption limit and you are not required to file income tax return but still if you file the belated return then sec 234F penalty shall not be applicable.

Q- If my income is below Rs. 2,50,000 and i am filing return voluntarily after due date then whether in that case also would i have to pay late fees?

No, fees u/s 234F shall not be applicable in your case if your income is below exemption limit or nil and you are filing the belated income tax return.

Q- I am filing a belated income tax return then whether interest u/s 234A will also be levied along with payment of fees u/s 234F?

Yes, both will be applicable simultaneously in a situation when your tax is payable. However, in case of late filing of return when no tax is payable then interest under sec 234 A shall not be levied and only late fee u/s 234F shall be leviable.

Just don’t get confused in both of these sections. Sec 234A speaks for levy of interest at the rate of 1% on the tax amount due while section 234F talks about levy of a definite amount of late fees depending on the date of filing of the return.Therefore, both will be applicable in case of delay in filing of return u/s 139(1) if your tax is unpaid.

Q- What will happen in case my total Income exceeds Rs. 5,00,000 and I have filed the return after due date i.e. on 03/09/2019 with the applicable fees?

In this case, after the e-verification of return, it would be processed by the income tax department as per the normal provisions of the income tax law.

Q- Is there an exemption for the senior citizen from the fees under section 234F?

No there is no such exemption of penalty under section 234F. The conditions of levy and the quantum of fees remain the same in case of every individual including super senior citizen.

Q- If i will be receiving the refund on the ITR of F.Y 2018-19 then also whether section 234F penalty shall be applicable?

Yes, even if you are eligible to receive the refund in ITR of F.Y 2018-19 and onwards still late fees u/s 234F shall be applicable in your case as per the applicable provisions.Further, the Income Tax department shall first adjust the fees and then the interest( if any) from your refund amount.

Q- New Section 234F applicability?

Section 234F becomes applicable to an assessee when he/she is compulsorily required to file an income tax return & files income tax return after 31st July, 2019 (now extended till 31st August, 2019).

Q- What is the difference between Sec 234F & Sec 234E of Income Tax Act?

Section 234E levy late fees on delay in submitting TDS return after the relevant due dates. While on the other hand, Sec 234F levy late fees on filing income tax return after 31st July, 2019 (now extended till 31st August, 2019).

Q- What is Section 139 of Income Tax Act 1961?

Section 139 of Income Tax Act 1961 defines different types of income tax return which can be filed by various assessees. Like mandatory/ voluntary return u/s 139(1), loss return u/s 139(3), belated return u/s 139(4), revised return u/s 139(5), income tax return of a charity or religious institution u/s 139(4A) etc.

Q- What is Section 271F of Income Tax Act?

Section 271F imposes penalty on failure to furnish income tax return till the end of relevant AY at the discretion of assessing officer. But, from 1st April, 2017 Section 271F has been abolished & new late filing fee under Section 234F has been introduced.

Q- What is Section 234D of Income Tax Act?

Section 234D levy interest on excess amount of refund given to the assessee. When a refund is given to an assessee as per Sec 143(1) & later it is found that either refund was not due or excess refund has been given. Then on such excess tax refund, interest @ 0.5% per month is to be paid.

Q- What is interest u/s 234A?

Section 234A levy interest on delay in filing of income tax return @ 1% per month. You can read more about Sec 234A, Sec 234B & Sec 234C in our blog.

Q- What are the charges for filing income tax return?

Income tax return can be filed FREE of cost by the assessee by making self-assessment.In case, any consultation is needed for tax saving & planning then consultation charges are required to be paid.

Q- What is the difference between Gross Total Income and Total Income?

Gross Total Income is the total of all five heads of income namely Income from Salary, Income from House Property, Income from Business, Income from Capital Gain and Income from Other Sources.

Whereas Total Income is the income which is computed after subtracting all deductions under Chapter-VIA like life insurance premium, contribution to PPF, contribution to NPS etc. from the Gross Total Income. In other words, it is the amount of income which is offered for tax and that’s why it is also known as taxable income.

- Income Tax Slab & Tax Rates for FY 2020-21(AY 2021-22) & FY 2019-20 (AY 2020-21)

- Income Tax Return (ITR) Filing FY 2020-21: How to File ITR Online India

- Form 16: What is Form 16? Form 16 Meaning, Format & How to Upload

- Tax Benefits on Housing Loans for Home Buyers

- Section 234F: Penalty for Late Filing of Income Tax Return