Form 16 is a certificate issued to salaried individuals from their employer when he deducts tax from the employee salary. In simple words, it is an acknowledgement which states your deducted tax has been deposited with the income tax department.

Form 16 is an important document that is issued in accordance with the provisions of the Income Tax Act,1961. A form 16 contains details of the amount of tax deducted at source (TDS) on salary by your employer along with the salary breakup for the financial year. In a nutshell, it could be said that a Form 16 is a certificate of proof of the TDS deducted & deposited by your employer.

Form 16 is a very important document as it:

Income Tax Law, mandates the employer who holds TAN no and deduct tax on salary of employee to issue Form 16. If your tax is not being deducted then your employer can refuse to issue Form 16 to you.

It must be issued by 15th June of the year for which it is being issued. For example, for the F.Y. 2017-18, the due date for issue of Form 16 was 15th June, 2018. If any employer delays or fails to issue Form 16 by the specified date, then he is liable to pay a penalty of Rs.100 per day till the date the default continues.

Understanding & learning how to fill form 16 is very simple. It is divided into two sections- Part A and Part B.

This part of income tax form 16 covers employer, employee,TDS payment details. It shows quarter-wise details of your tax deposited with the government.Some of the details are:

This part shows the detailed computation of Income, on the basis of which tax is being calculated and deducted by your employer. It contains the breakup of the salary earned by you, various deductions, exemptions (if any) and the tax computation after considering all the items on the basis of current tax slab rates. The details mentioned in Part B are as follows:

A. Gross Salary(1): This part of Form 16 requires details of salary as per provisions of section 17(1), perquisites and any profits received in lieu of salary.

B. Exemptions and allowances considered(2) : Earlier in this part of form , combined information of all the exemptions under Section 10 was required, but with the introduction of new Form 16 , a list of allowances is provided, and the details are required to be filled. The list of allowances are as follows:

C. Total Amount of Salary received from Employer (3): This part of form calculates the total salary received including allowances and other perquisites.

D. Deductions under Section 16 (4): Budget 2018 announced the standard deduction in lieu of transport and medical allowances received by the employee. In the new form 16 a separate column for standard deduction is introduced. All the deduction columns are mentioned below:

E. Total amount of deduction under section 16 (5)

F. Income Chargeable under the head “Income from Salaries”(6): this column shows the net income form salary after deduction of all the allowances and deductions

G. Any other income declared by employee as per section 192BB (7): This column of form enables the employee to declare any other income with the proofs of the income.

H. Total amount of other income reported by employee(8): This column provides total of all income earned by an employee other than salary.

I. Gross Total Income (9): This column of the form indicates total income of employees reduced by the exemptions but before deduction under Chapter VI-A.

J. Deduction under Chapter VI-A (10): Earlier, there was no separate list of deductions, an option was there to disclose the section under which deduction has been claimed. But in Form 16,disclosure of deductions is required as per separate list.

K. Aggregate of deductible amount under Chapter VI-A (11): This column totals the amount of deduction from all the sections under Chapter VI- A as claimed by employee.

L. Total taxable Income (12): This column refers to the net income of the employee after considering deduction under Chapter VI-A.This is the amount on which tax is calculated.

M. Tax on Total Income (13)

N. Rebate under section 87A, if applicable (14)

O. Surcharge, wherever applicable (15)

P. Health and education Cess (16) : This column is introduced in the new Form 16, as health and education cess is announced in Budget 2018.

Q. Tax payable (17)

R. Relief under section 89 (18)

S. Net tax payable (19)

As per the procedure laid down by the Income Tax Department, the person deducting your tax files return with the government. Thus, The TDS entries get updated in the department’s database once your employer files the TDS return. The last date to deposit the TDS for the month of March is April 30. The TDS return for the last quarter (Jan to March) is to be filed latest by 31st May. After the TDS return is filed, it takes 10 to 15 days to reflect the entries in the department's database. Then after, your employer downloads the Form-16 and issues it to you.

Form 16 is issued by your employer and you can expect it by the end of May/June. But if it’s not issued by the end of June, then you may demand it from your employer. Generally, the accounts or HR department issues Form 16.

Form 16 is the most important document for you to file your income tax return and you should preserve this document carefully. But if you’ve lost it, do not panic, check your mail whether it has been emailed to you by your employer or not. If it’s not sent to you on your email, then you can simply request your employer to issue a copy of Form 16.

Yes, income tax return can be e-filed even without income tax form 16, you are required to have all the necessary documents of your sources of income, any perquisites , allowances claimed, investments made, medical payment and any donations made.

If your Gross Total Income exceeds 2,50,000 [for F.Y. 2018-19] then it is mandatory to file an income tax return. Your employer is liable to issue form 16 only when he has deducted tax from your salary. If your employer does not deduct tax and your income exceeds the specified limit then even if you don’t have form 16, you are required to file return of income.

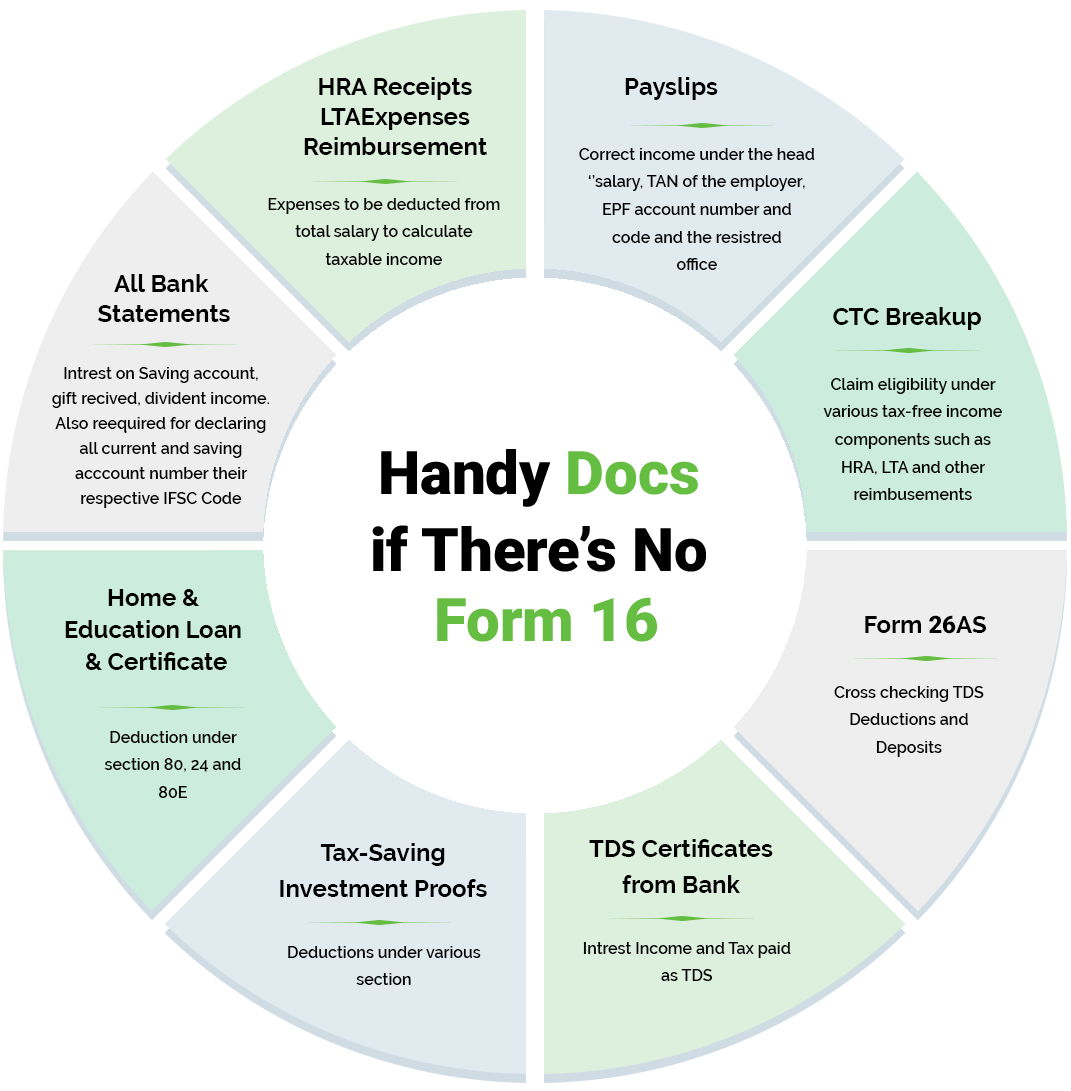

If you haven’t received a Form 16, then for the purpose of return filing, you will have to refer to your salary payslips, bank statements, tax-saving investment proofs, home and education loan certificates and Form 26AS etc for filing income tax returns. While payslips contain details of your income like basic salary and allowances, Form 26AS contains the details of all your tax deducted and tax paid.

The Form 26 AS can be viewed / downloaded from the Income Tax Department’s online portal i.e. www.incometaxindiaefiling.gov.in.

For example, Ms. Tania was working with XYZ Ltd. and she didn’t receive any Form 16. In such a case, she consulted experts and they calculated the income on the basis of her monthly payslips which showed a basic salary of Rs. 30,000 per month. It also had details of transport allowance of Rs. 2,000 per month. Further, she had her home loan certificate, because of which she was allowed a deduction of Rs. 50,000 from her income. Hence, the final calculated income of Ms. Tania would be calculated as follows:

Basic Salary = 30,000 x 12 months = 3,60,000

Transport Allowance = 2,000 x 12 months = 24,000 but subject to an exemption of Rs. 1600 per month.

Therefore, 400 x 12 = 4,800 is taxable.

Hence, the Taxable Income [after deducting the basic exemption limit] of Ms. Tania will be Rs. 64,800 (3,60,000 + 4,800 – 2,50,000 (basic exemption) – 50,000 deduction for home loan).

In such a case, where your employer deducted tax from your salary, but you are not able to trace such deduction in Form 26AS, then it may happen that your employer has deducted the tax from your salary but has not deposited the same in the credit of the Government account. And, in such a case, you must pay the full amount of tax while filing your income tax return. Also, you should immediately bring this matter or default to the notice of your employer.

Need a CA to bail you out of this situation? Connect Now.

In a case where your employer issues you a Form 16 without any deductions, you can still claim the deduction on your income tax return. Form 16 is just a certificate issued by your employer which certifies deduction of tax (TDS) on your salary. It’s just a base document for return filing and not the final return itself. You can always take the benefit of the deductions you are eligible for, while filing your income tax return even if the same are not mentioned in your Form 16.

Our experts say “Always remember to check whether the House Rent Allowance exemption has been taken in Form 16 or not (if you’re entitled to it). It is usually either not reflected or calculated at a wrong value especially in the case of multiple employers during the year. In such an event, you yourself can calculate it and take the exemption of same while filing your income tax return.”

Trouble filing your income tax return? Just click here!

If you have received arrears of salary, but the arrears are not shown in Form 16, then also you can shown your arrears in the income tax return. All you required is all the details of salary in arrears and Form 10E which is a necessary required to claim relief on arrears of salary under section 89(1).

You can upload income tax form 16 and e-file your return with File My Tax online by following some simple steps:

In case, where a Form 16 is duly issued but with a mistake, then the same can be rectified by your employer on your request. Subsequently, a revised Form 16 will be issued to you by your employer.

| Form 26AS | Form 16 |

| Contains details of tax deducted at source (TDS) for all the heads of income. | Contains details of tax deducted at source (TDS) for the income from salary only. The details of other heads of income can also be provided in your Form16, in case you have provided the details of other income to your employer. |

| Provided on the Department’s site based on data submitted by all the Deductors. | Issued by your employer to you. |

No, a Form 16 is not equivalent to an Income Tax Return but it’s the source document for your salary income. It is really helpful, especially in case your entire income is from salaries and there is no other source of income. Further, you don’t need to attach your Form 16 with your income tax return.

It is very much possible for you to change your job in the middle of the year, but then you may be wondering who will issue Form 16.

In case, you had two employers for the year, you will get Form 16 from both the employers for the respective months served by you. The income tax return will be filed by combining the details of both the Form 16s. But you must be careful in doing so because it might happen that both your former and present employer has calculated your tax after taking into consideration the basic exemption limit. In such a case, you are not entitled to take the benefit of exemption limit twice, but only once.

The same applies to all deductions and allowances during the year, as any deduction / allowance can be claimed only once or as per the respective rules of the income tax law even if it is reflected in both the Form 16’s.

For example, let’s say, in the year 2018-19, you worked with a company X Pvt. Ltd. for a period of 6 months for a salary of Rs. 45,000 per month and for the rest 6 months you joined Y Ltd. for Rs. 50,000 per month. In such a case, you draw a salary of Rs. 2,70,000 from X Pvt. Ltd. and Rs. 3,00,000 from Y Ltd. Now, both the companies X Pvt. Ltd. and Y Ltd. will deduct your tax after consideration of the basic exemption limit (i.e. Rs. 2,50,000/-) only and your Form 16 will be based on the same. This means X Pvt. Ltd. will charge tax on the balance Rs. 20,000 and Y Ltd. will charge tax on Rs. 50,000, each giving you an exemption of Rs. 2,50,000. But, at the time of filing your final return for the year, you will be allowed the basic exemption only once and not twice i.e. your tax should be charged on Rs. 3,30,000. (Rs. 300000 + 270000 – 250000).

Further, when you switch jobs in a year, then you should furnish your previous employer’s TDS details to your new employer in Form 12B.

Form 60 is declaration made by individuals who does not have PAN whereas Form 16 means income certificate issued by employer to employee.

Form 16B is certificate of tax deducted on sale of property whereas part b of income tax form 16 consists of all the details of salary breakup, deduction and taxes paid by employer on behalf of employees.

All the employers are required to deduct TDS whose employees salaries exceeds Rs.2.5 lakhs(before deductions).Every employer, who has deducted TDS has to issue Form 16 to employees as a certificate of TDS deduction.

Form 16 is the certificate declaring TDS deducted by the employer has been deposited with the government.

TDS return under form 24Q is required to be filed by the employer for deduction of taxes on salary of the employee. After 24Q is filed, Form 16 can be generated and provided to the employees after the end of financial year.

Every employee is required to submit documents related to mediclaim paid, donations made, rent receipts, lic premium receipt and proof of any other income received in form 12BB to enable him to calculate TDS amount to be deducted from the salary.

The responsibility of the employer for income tax form 16 is that he should ensure that all the income of the employee has been compiled, required tax has been deducted & deposited with the government, TDS return has been filed within due date and Form 16 issued to employees on time.

The last date to issue Form 16 is 15th June of the year for which it is being issued. For example, for the F.Y. 2018-19, the due date for issue of Form 16 shall be 15th June, 2019(extended to 10th July 2019).

If any employer delays or fails to issue Form 16 by the specified date, then he is liable to pay a penalty of Rs.100 per day till the date the default continues.

There is always a way to right the wrong. If you have filed the incorrect details in TDS return , you can correct the same by filing revised TDS return and reissue Form 16 after successful processing of TDS returns.

New Form 16 has been issued on 12 April 2019 vide notification [Notification No. 36/2019/F.No. 370142/4/2019-TPL]. This has been done to bring in line the disclosure amendments made by Budget 2018. This new format shall apply to all the Form16 to be issued by employers by the 30th of May 2019. Get below a brief understanding of the key changes announced by the Government in Form 16 - Part B,

1- Earlier, there was only one common column where exempt allowances as per section 10 was required to be shown. Now, as per the revised format, a specific list of exempt allowances is shown,such as:

A similar break up is also asked in the Annexure II of Form 24Q i.n. TDS Return and ITR Form.

2- The amount of Standard Deduction u/s 16(ia) is required to be disclosed now onwards.3- A specific list of all available deductions as per chapter VI-A is required separately. A similar break up is also asked in the Annexure II of Form 24Q i.e. TDS Return and applicable ITR Form.4- Education Cess has been replaced by Health and Education Cess.

Changes have been made both in Part -B of Form 16 and Annexure II of Form No 24Q [ TDS Return]. ITR Forms have also been recently released for AY 2019-20 by the income tax department, where detailed break up is asked. Considering the changes, now break up of the Income, Deductions, Exempt allowances/receipts are to be provided by the Employer and employee both. Thus, the income tax department will put the checks for the possible evasion of tax. Also, it will be easy for the taxpayers to fill the ITR as proper information will be available in Form 16. ITR Form is also changed this year where the break up of salary is being asked as per the format of Form 16.

Form 16 is a TDS certificate & it is issued only when there is tax deducted. Therefore, if there is no tax deducted, the employer is not required to issue Form 16 to you. Purpose of form 16 is to serve as a proof of tax deducted & deposited on your behalf.

Our user-friendly interface helps you file ITR within minutes.

Just follow these 3 simple steps -

Form 16 is required when you are filing your income tax return. This form serves as a proof that your employer has deducted & deposited tax from your salary with income tax department in your name.

All the employers, if they deduction TDS, are required to issue Form 16 by 15th June of the financial year.

Any amount received from your employer during employment period is called Salary. Usually it comprises of basic salary, allowances, bonus, pension, wages or any other benefit given in relation to your employment.

When an employer deducts tax from your salary, he issues Form 16 to you. This form is an acknowledgement from your employer that he has deducted tax from your salary.

Yes, pension income is taxable under the head “Income from Salary”. If it is exceeds the basic exemption limit then provisions of TDS shall become applicable & Form 16 is required to be issued by your employer. Further, pension received from United Nations Organisation & by kin of Armed Forces is exempt. For more detailed explanation on taxability of pension, refer our blog.

No, family pension is not taxable under head “ Income from Salary” because it comes within the ambit of “Income from Other Sources”. Therefore, Form 16 is not required to be issued in such cases.

Yes, your employer is required to consider Sec 89 of Income Tax Act for calculation purposes, in case you receive any arrears or advance salary income. Refer our blog for detailed information on sec 89.

At File My Tax online, for filing online income tax return you can choose amongst the two available options as per your convenience. One is SELF FILING and the other is CA ASSISTANCE.

If you wish to opt for eCA then you just have to answer a few simple questions & accordingly we will recommend the best suitable plan for you. Pay online for your plan & our eCA will get in touch with you. Share all your tax problems, upload relevant documents & let your personal eCA do the hard work for you.

Additionally, if you want to opt for self filing then you can easily file your ITR online with us and that too for FREE. Visit File My Tax online, choose “File It Yourself” option & select all your income sources. Upload required documents, confirm & voila your ITR is filed.

You need to verify your ITR within 120 days of filing it, so that income tax department can process it further. It is very important to note, if you do not verify your ITR it shall not be considered as filed. To know how to e-verify your return, click here.

Both Form 16 & 16A are TDS certificates. While Form 16 is a representation of tax deducted for salaried employees, Form 16A represents tax deducted on income other than salary.

You can visit our glossary page on Form no. 16. Here, you can see the full structure of Form 16 & see all the components of it.

Form 16 issued by Municipal Corporation of Greater Mumbai (mcgm) is known as Form16 mcgm. To download Form 16 mcgm, all you need to do is:

Income tax slab rate for A.Y. 2019-20 for individual is:

| Income upto | Rate |

| Upto 2, 50,000 | NIL |

| Above 2,50,000 but upto 5,00,000 | 5% |

| Above 5,00,000 but upto 10,00,000 | 20% |

| Above 10,00,000 | 30% |

An employee should verify the following details before filing income tax return :

Ans. Form 16 is issued by employer to employee therefore employee can get form 16 from employer of any year.

Form 16 helps in companies to verify new employees package, incentive, bonuses. It helps in verify previous employer details and tenure of working with previous employer.

Ans. pension holders can get their form 16 from the respective bank. Because they are responsible for deduct TDS on income amount.

Ans. Form 16 Part A be given to employees whose TDS is not deducted. it can be downloaded from the traces site.

Ans. It will get 10 to 15 days for correction form 16 from the site.

Ans. Yes, you are still liable for the form 16 if TDS is deducted or not.

No, Form 16 can only be given by employer as to generate Form 16 you require TAN which is beholden by employer only.

Ans. Form 16 and ITR acknowledgement are different things. ITR acknowledge is document that your return is successfully submitted with department and form 16 is issued by employer to employee

Ans. Form 16 is not necessary for filing income tax returns. for filing income tax return you only needed income details.