What is Form 60 and when is it required?

Today, when you decide to enter into any transaction with banking institution, or deal in some sort of assets then PAN card is the basic identity proof which is required.

But, there are still a number of people who do not possess PAN or they might have already applied for PAN and are waiting for allotment. Form 60 can be used in lieu of furnishing PAN by such people in many cases.

Form 60 is a declaration to be filed by an individual or a person (not being a company or firm) who does not have a PAN and who enters into any transaction specified in rule 114B.

Other than tax authorities, PAN or Form 60, is required for a variety of transactions such as:

| Nature of Transaction | Value of Transaction |

|---|---|

| Sale or purchase of Motor Vehicle [other than two wheeled vehicles] | Irrespective of value / Any Value |

| Opening a Bank account | Irrespective of value |

| Getting new Debit or Credit card | Irrespective of value |

| Opening D- MAT account | Irrespective of value |

| Payment to hotel or restaurant at one time | Cash payment exceeding Rs 50,000 |

| Travelling expenses to foreign country or buying foreign currency at one time | Cash payment exceeding Rs 50,000 |

| Buying Mutual funds | Amount exceeding Rs 50,000 |

| Acquiring bonds or debentures | Amount exceeding Rs 50,000 |

| Acquiring bonds issued by RBI | Amount exceeding Rs 50,000 |

| Depositing money with (a) Bank (b) Post Office |

Cash exceeding Rs 50,000 in one day |

| Purchasing Bank Draft/ pay order/ banker’s cheque | Cash exceeding Rs 50,000 in one day |

| Time deposit (FD) with (a) Bank (b) Post Office (c) NBFC (d) Nidhi company |

Exceeding Rs 50,000 at a time or Rs 5,00,000 in a financial year |

| Life Insurance Premium | If amount exceeds Rs 50,000 in a FY |

| Trading in securities | Amount Exceeding Rs 1,00,000 per transaction |

| Trading in shares of unlisted company | Amount Exceeding Rs 1,00,000 per transaction |

| Sale or purchase of any immovable property | If amount or registered value exceeds Rs 10,00,000 |

| Buying and selling of goods and services | Rs 2,00,000 per transaction |

PAN v/s Form 60, Can Form 60 substitute PAN in all cases?

Well, Form 60 is recourse to furnishing PAN but, NOT in every scenario. Form 60 is not and can never be a replacement of quoting PAN. It is just for the sake of users government has provided us some relaxation, for a particular class of transactions.

Every communication made to income tax department is traced through your PAN whether it is filing return, getting refund, serving notices or any such other communications. In certain cases the department lays mandatory requirement upon a person to possess PAN, these cases as per section 139A include

- When you exceed the mandatory filing threshold of ITR

- Your turnover in business or profession exceeds 5,00,000/-

- Resident other than individual entering into financial transaction aggregating to Rs 2.5 lakhs or more in a year

- Every MD, Director, Karta of HUF, Partner of a firm etc

- Person filing return under section 139(4A)

- Employer liable to file ITR for giving fringe benefits

Complying with KYC requirement, even the prevailing E- KYC norms for e commerce industry like Paytm, OLA etc also require PAN.

What is the applicability of Rule 114B on Minor?

Rule 114B of Income Tax Act 1961 expressly provides that, if, minor enters into any of above specified transactions and he does not have income chargeable to tax, then Minor can quote PAN of his Father, Mother or Guardian while entering into such contracts.

Whether NRI needs to submit Form 60?

As per Rule 114B, Non Residents are required to quote PAN or file Form 60 only for limited number of transactions, which are as under:

| Nature of Transaction | Value of Transaction |

| Sale or purchase of Motor Vehicle | Irrespective of value / Any Value |

| Opening a Bank account | Irrespective of value |

| Opening D MAT account | Irrespective of value |

| Buying Mutual funds | Amount exceeding Rs 50,000 |

| Buying bonds or debentures | Amount exceeding Rs 50,000 |

| Depositing money with (a) Bank (b) Post Office |

Cash exceeding Rs 50,000 in one day |

| Time deposit (FD) with (a) Bank (b) Post Office (c) NBFC (d) Nidhi company |

Exceeding Rs 50,000 at a time or Rs 5,00,000 in a financial year |

| Life Insurance Premium | If amount exceeds Rs 50,000 in a FY |

| Trading in securities | Amount Exceeding Rs 1,00,000 per transaction |

| Trading in shares of unlisted company | Amount Exceeding Rs 1,00,000 per transaction |

| Sale or purchase of any immovable property | If amount or registered value exceeds Rs 10,00,000 |

For remaining transactions like payments made to hotels and restaurants, getting debit or credit card, travelling expenses etc Non Residents are not required to furnish PAN or Form 60 in lieu of PAN.

Does Rule 114B exempts any other person except NR and Minor to quote PAN?

Yes, like NR and minor, Central Government, State Government and Consular offices are also completely exempted from quoting PAN while making any transaction referred in Rule 114B.

What is the manner of submission of Form 60? Can it be submitted online?

To the relief of user, Form 60 can be submitted both online and offline. Offline i.e physical submission of Form 60 can be made to the concerned authority, after duly filling up the form. For eg. If your are submitting Form 60 as per Income Tax Act then submit it to Tax Authorities or if you are filing Form 60 for opening a bank account submit it to the concerned bank.

The online procedure to file Form 60 with the Income Tax Department shall follow as under

- A) The electronic verification can be done through this website- https://report.insight.gov.in/reporting-webapp/portal/homePage

- B) It can also be done using certain Aadhaar specified Authentications :

- TThrough OTP on your aadhar linked mobile number or mail ID.

- Through Biometric modalities i.e. either through iris (scanning your eye) or fingerprint.

- Two way authentication i.e. OTP + biometric modalities

- Or, Use of OTP & fingerprint & iris all together.

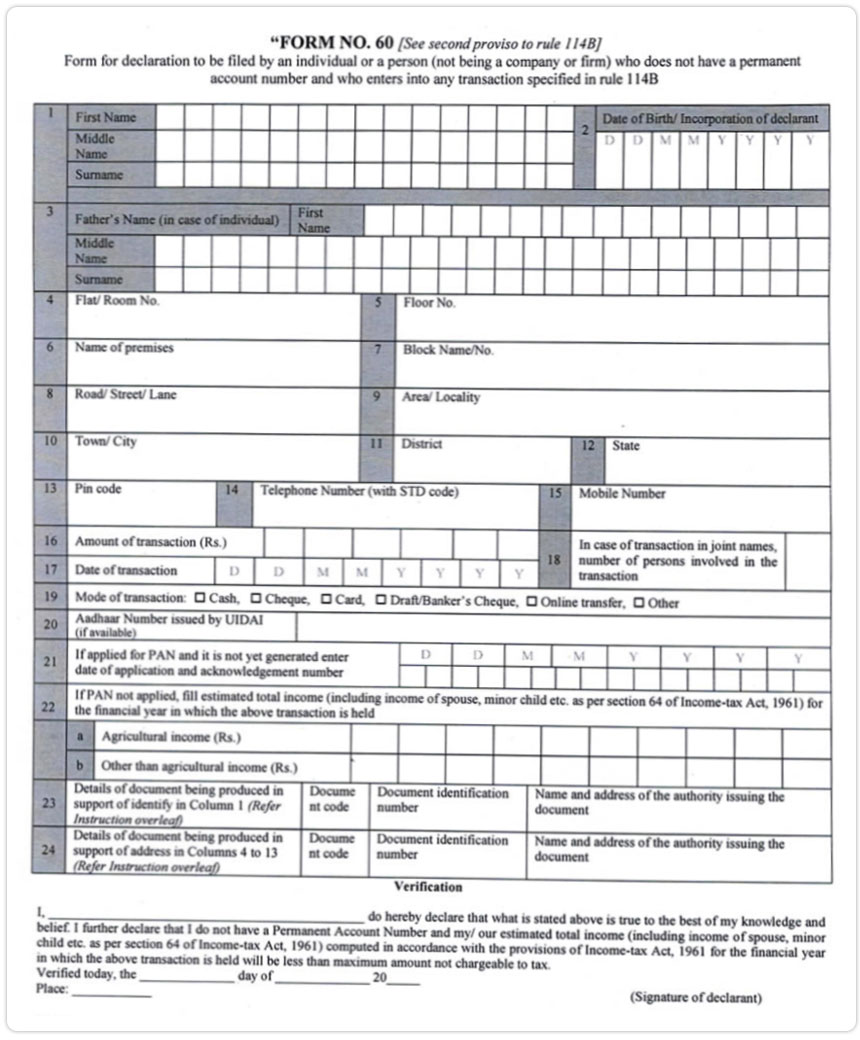

How Form 60 looks like?

By now we have discussed so many things about Form 60. You might be curious to know how form 60 actually looks like, is it too lengthy, it it a set of forms or how it is actually!! WELL to rest all your queries, a simple one page specimen of Form 60 has been annexed herewith.

What are Documents to be submitted with form 60?

Some documents which are required to be annexed while submitting Form 60 are

- Aadhaar Card

- Driving license

- Bank Pass Book (having photograph)

- Elector’s Photo ID

- Ration Card

- Passport

- Pensioner Photo card

- Proof of address

- Telephone bill and electricity bill copies

- Communication or document issued by Central or State Government or local bodies

- Domicile Certificate

- Kisan passbook

- Arm’s License etc

There are many other proofs, a list of which can be found attached to Form 60.

If you have already filed Form 49A for allotment of PAN, you just need to render the application receipt and bank account summary of 3 months. No other documents from the list as specified above will be further needed.

What are the various Information required to be filled in form 60?

Information as stated below are required to be furnished while filling form 60

- Your complete name

- Date of Birth

- Full address

- Telephone Number / Mobile Number

- Amount of Transaction

- Date of transaction

- Mode of transaction

- Aadhaar number

- If PAN applied then application and acknowledgement number

- Disclosures of income

- Sign and mention date and place.

If you do not have any information to be disclosed in a particular column write - “Not Applicable”.

Are there some Consequences of wrong declarations made in Form 60?

AAny wrong declaration in Form 60 will make you entitled to repercussions under section 277 of the Income Tax act 1961.

As per provisions of section 277, person disclosing misleading or untrue information will be held liable as under :

- If resulting tax evasion amount exceeds Rs 25 lakhs, rigorous imprisonment of minimum 6 months to maximum 7 years + fine as applicable.

- For other cases, rigorous imprisonment of at least 3 months to 2 years with fine.

Are there other forms related to PAN, apart from Form 60?

Yes there are few forms which are also related to PAN. A short description of these forms has been mentioned below :

49A - This Application form is used by Residents of India to obtain PAN and for correction of PAN.

49AA - Unlike 49A, this application form is used by Non Residents (foreigners) or bodies incorporated outside India to obtain PAN in India.

Is there any difference between Form 60 and Form 16?

These two forms are altogether different. Where form 60 is used as a document in lieu of furnishing PAN for some financial transaction, Form 16 is issued by your employer, which enlists your components of salary etc.

How many times can I use form 60?

You can use Form 60 as many times as it is required. But, if you are furnishing Form 60 to the same person or authority subsequently, you can opt to disclose only the incremental information. Incremental information means the particulars which have changed after you filed Form 60 last time.

Form 60 is a boon for a person willing to enter into financial transaction, but was prevented to do so because he lacked PAN. Submitting of this form online as per the recent changes made by CBDT has added to the benefits. So, you are well equipped to fire back someone, next they instruct you to get PAN just for the sake of opening a Bank account or alike things. To get in touch with the expert team of CA’s, Contact Us Now!!

Frequently Asked Questions

Q- How many times can we use Form 60 for banking transactions?

Ans. Form 60 is a replacement of PAN card for various transactions that are specified in rule 114B in various conditions. There is no limit stated for usage of Form 60 for banking transactions. But the Form 60 is only valid for six years from the end of the financial year in which the transaction took place.

Q- Is a PAN or form 60 mandatory to open a basic savings bank account (BSBDA)?

Ans. Yes, PAN or a Form 60 is mandatory document to be furnished for opening any basic savings bank account.

Q- What is the maximum amount I can deposit to a savings account without having a pan card?

Ans. Any amount above Rs 50,000 to be submitted in a bank account is not allowed without a PAN card. Amounts below this limit can be submitted in a bank account without a PAN card.

Q- Can a minor fill form 60?

Ans. As per Rule 114B, if a minor is involved in transactions as mentioned in Rule 114B,and does not have income chargeable to tax , than a monir can quote PAN of his father, mother or any guardian and in any other case minor is required to fill Form 60.

Q- What is the validity of Form 60?

Ans. The Form 60 is only valid for six years from the end of the financial year in which the transaction was . carried by the individual.

Q- Is Form 60 required for NRI?

Ans. Yes, NRI that is Non Resident Indians are required to furnish Form 60 in place of PAN card. But Form 60 for NRI’s is only valid for few transactions mentioned in rule 114B.

- Income Tax Slab & Tax Rates for FY 2020-21(AY 2021-22) & FY 2019-20 (AY 2020-21)

- Income Tax Return (ITR) Filing FY 2020-21: How to File ITR Online India

- Form 16: What is Form 16? Form 16 Meaning, Format & How to Upload

- Tax Benefits on Housing Loans for Home Buyers

- Section 234F: Penalty for Late Filing of Income Tax Return