The Form 12BB is the form that you fill and give to your employer - not to the Income Tax Department - so that your employer can figure how much income tax is to be deducted from your monthly pay.

Basically , it contain the details related to tax deductible expenses and investments which would be done by you during the current F.Y.

Generally you fill out a form 12BB when you start a new job or in the beginning of the financial year. However, at the year end you are supposed to submit the actual proofs/evidences against the tax exemptions ,investments and expenses already claimed by you in the form 12BB.

Previously there was no standard format for declaring your tax deductible expenses and investments. With effect from 1st June 2016, Income tax department has introduced a standard format of Form 12BB.

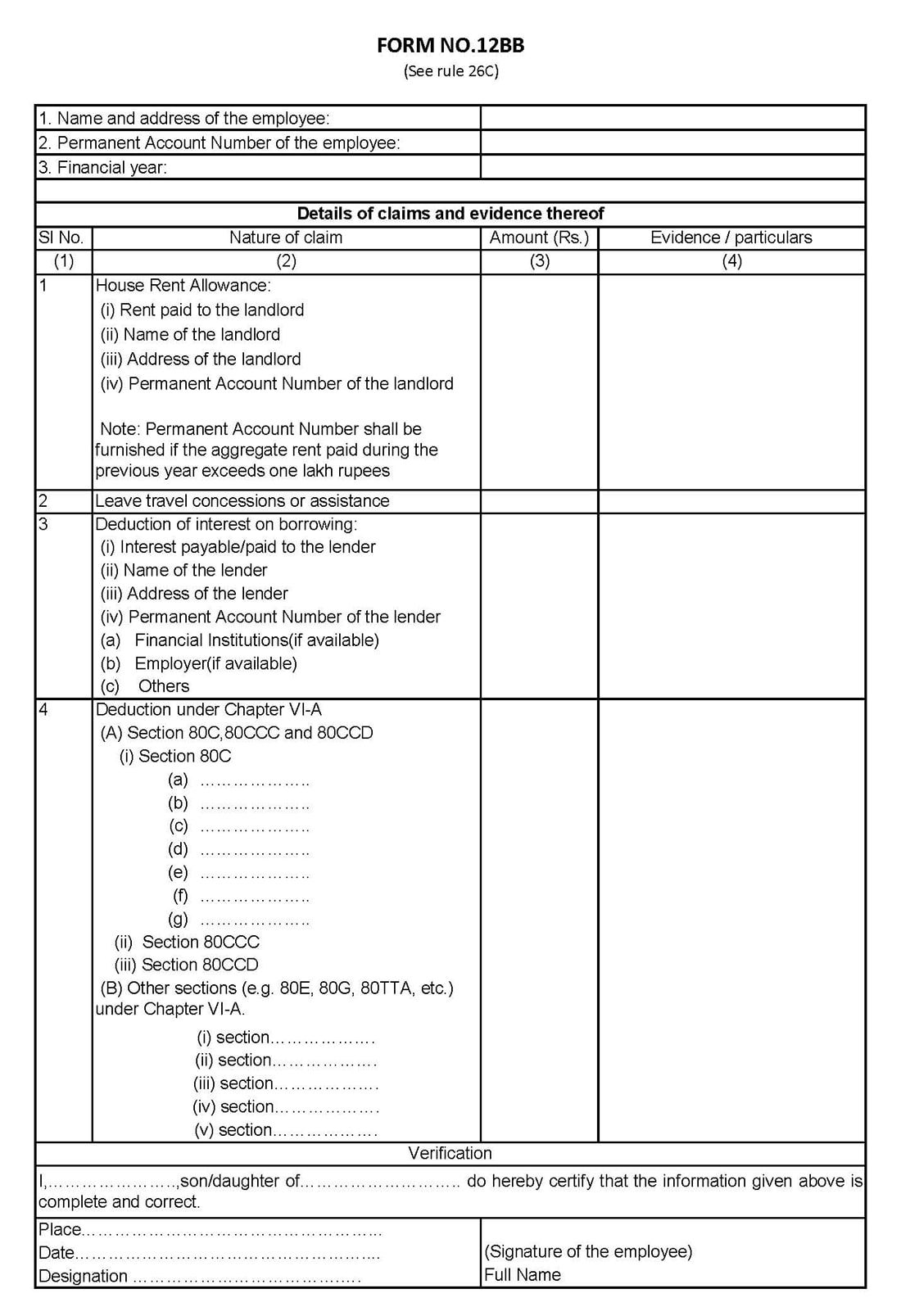

The form 12BB looks like this:

The Income Tax law gives powers to your employer to give you benefit of all the tax deductible expenses and investments made by you during the year at the time of deducting your income tax from your monthly paycheck.

However, just one condition is there , this benefit is provided to only those employees who submit their declaration / proofs of income tax deductions in Form 12BB are eligible for this benefit.Thus,Employees must complete this form so that their employers can know how much income tax needs to be deducted from their monthly paycheck and, in turn, how much money they will take home with each paycheck.

Now, that we have understood the importance of Form 12BB, let’s understand Form 12BB a bit in detail.

The Income Tax Department has made a standard format of Form 12BB. It has to be prepared as per Rule 26C of the Income Tax Rules.You can download the form 12BB online in pdf or word format, print, fill and submit to your employer alongwith the required proofs.

Alternatively, you can fill Form 12BB online and either mail to your HR directly or print, sign and submit to your employer alongwith necessary proofs.

The details required to be reported in Form 12BB are:

Filling tax forms can be a nightmare for many of us. However, filing Form 12BB isn’t as scary as it might look. So,let’s just get down with it!

Just follow these instructions to understand and fill the complete form to claim maximum tax benefit. Now Let's Discuss each part one by one in detail :

This is the first section of Form 12BB, you need to mention your :

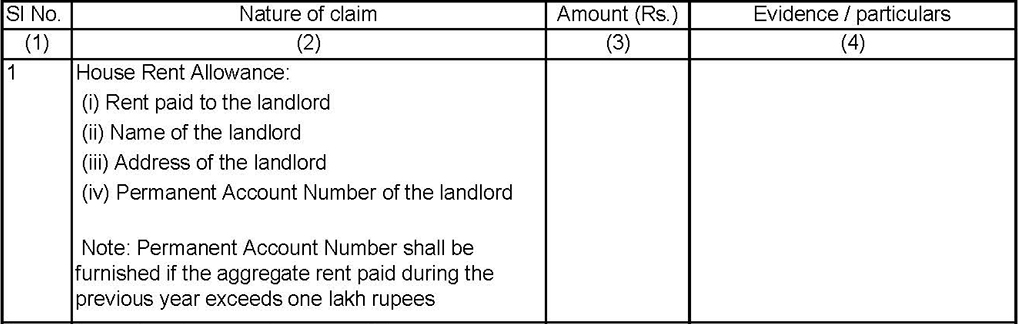

For claiming HRA tax exemption, you need to submit the following details to your employer -

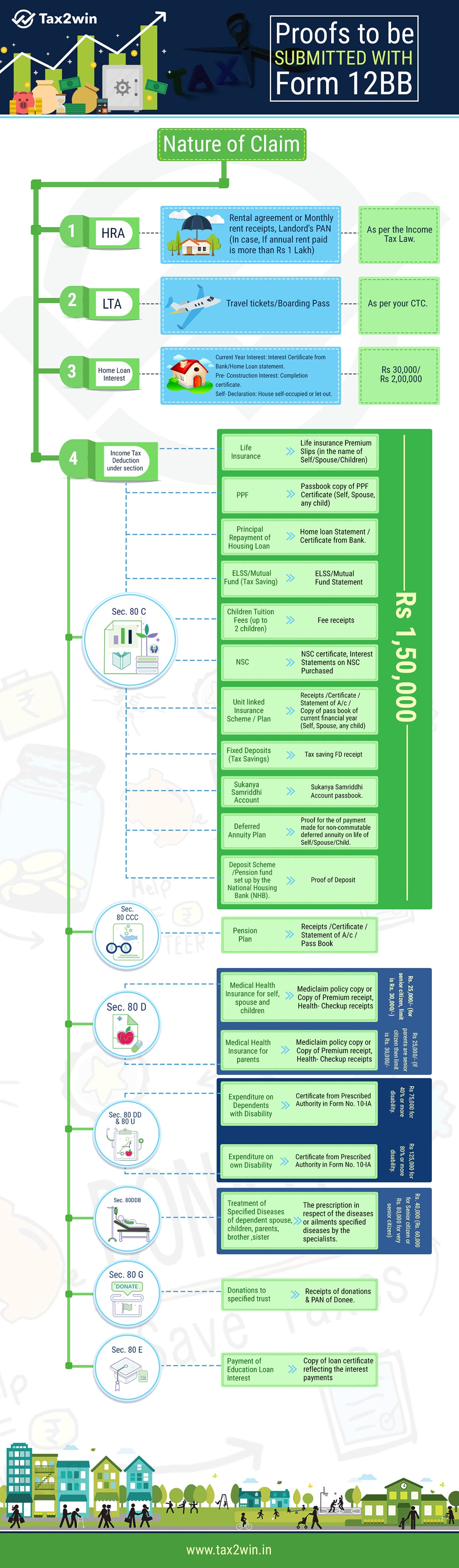

In Addition, you also need to submit the proof for claiming HRA tax exemption .

The proof for claiming HRA tax exemption are the monthly rent receipts. In many organisations, employer also ask for the rent agreement for allowing HRA tax exemption.

This is the best tax saving avenue.Calculate your HRA tax exemption with our free HRA exemption calculator tool.

Read our complete guide on rent receipts to know in detail how you can claim HRA tax exemption to save maximum tax

This allowance is one and the only allowance that helps saves tax only when you take a holiday.

To claim LTA, employees need to submit travel bills like boarding passes, flight tickets, invoice of travel agent, boarding pass etc. to employer.

This tax exemption is allowed only on actual travel cost to the extend specified in CTC.The fare is exempt as per the following conditions:

| Travel Mode | Exempt Amount |

|---|---|

| Air | Air fare of economy class in the National Carrier by the shortest route or the amount spent, whichever is less |

| Rail | Air-conditioned first class rail fare by the shortest route or the amount spent, whichever is less |

| Bus | First Class or deluxe class fare by the shortest route or the amount spent, whichever is less |

| Unrecognised public transport system | Air conditioned first class rail fare by shortest route or the amount spent, whichever is less |

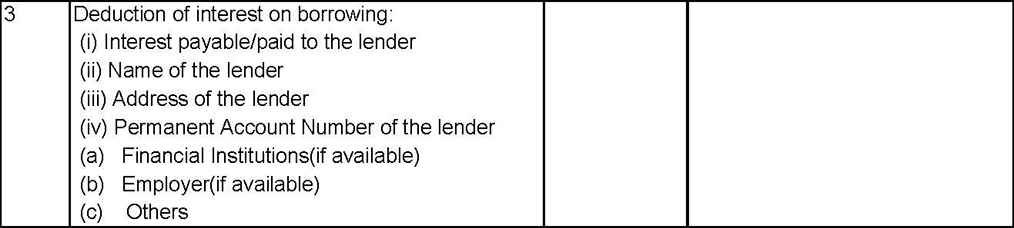

Deduction of interest on borrowings on home loan is allowed under section 24 of the income tax laws. You can claim deduction for interest on your home loan taken for construction,reconstruction, repair, purchase or renovation.

The information needs to be filled in the Form 12BB are:

Documents required to claim deduction u/s 24B on interest payment of home loan are:

If you are paying interest on home loan, then quantum of deduction will depend on the type of house property. Let’s discuss the same in detail.

Tip : Claiming deduction on interest payment shall result in a loss under head house property. This loss can be adjusted against income from other heads in the current year subject to the limit of Rs. 2 lakh.

Maximum interest of Rs. 2, 00, 000 is allowable in case loan is taken for purchase or construction of your house. Such benefit shall reduced to Rs. 30, 000 in case loan is taken for repair/ reconstruction. Further, construction or purchase must be completed within 5 years from end of F.Y. in which loan is taken.

The entire interest amount that you pay towards the loan is available as deduction in case of rented property. Such amount shall be deducted from the rental income for the year

Note : However, from 1 April 2017 onwards i.e. F.Y. 2017-18, the maximum tax exemption of Rs.200,000/- can be taken for all type of houses(let-out/self-occupied). Incase, you have paid more than Rs.2,00,000 as interest on home loan taken for construction/purchase, then the remaining amount shall be allowed to be carried forward for set-off in subsequent years.

In both the cases whether there is self-occupied property or rented property, principal amount repayment is eligible to be claimed under Sec 80C of the income tax act. A maximum of Rs. 1.5 lakh can be claimed under Sec. 80C for the principal amount.(Max. limit of claiming all deductions under 80c is 1.5 lakh.So, plan accordingly.)

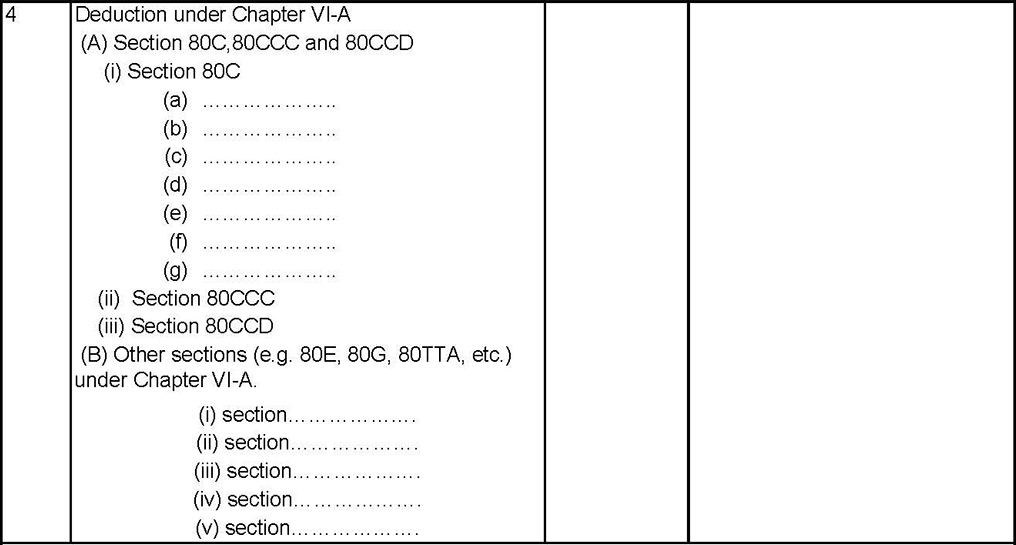

This part of the form may take more time to finish if you are claiming maximum tax benefits .If you do not have any deductions to make, you can then move on to last section.

Chapter VI-A covers income tax deduction under various sections like 80C, 80D (Medical insurance) 80G (Donation) etc. To claim deduction, evidence of investment made or expenditure incurred is required. You might be wondering what kind of proofs are required to submitted to claim these deductions. Don’t Worry, we are here to help you.

The last section of the Form 12BB is the “verification” of the information submitted in the Form 12BB. You need to just enter your name along with the name of your father/mother and the place(city in which you are filling the form) and date of filing the form and then sign the form.

Done!

Easy isn’t it!

“In order to avoid tax deduction altogether, you’ll have to have no tax liability this year “

If you have changed the jobs during a particular year then do not claim the maximum benefit of all the deductions with both the employers, otherwise your TDS deduction will not be correct and ultimately at the time of filing your Income Tax Return you will have to end up with paying tax to the Income Tax Department with applicable penal interest for late payment of taxes.

In case you forgot to submit form 12BB to your employer within the prescribed time, the employer will not be able to give you benefit of deductions and other tax exemptions. As a result, excess TDS will be deducted from your monthly salary.However, you can claim refund of such excess TDS while filing your income tax return.

Perquisites are claimed in Form 12BA and not Form 12BB. Form 12BA is a statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value thereof.

The additional investments which an individual had missed and not declared in Form 12BB can be claimed while filing return. Although, excess TDS will be deducted from his salary during the year, however he can claim refund of the same in his ITR.

If you have not submitted proof of some investments which you have declared in Form 12BB then those would not be considered by your employer. Resultantly , TDS would be calculated ignoring those proofless investments.

Tax season can be a confusing and overwhelming time. With the number of different tax forms and sections out there, it’s difficult to keep track of them all. One way to ensure a stress-free tax season is by correctly filling out your form 12BB when you start a new job or in the beginning of the year. In addition, it’s a good idea to start your tax preparation early and stay on top of the process.

If you’re unsure whether you need to file your taxes, there’s an income threshold that helps determine whether you should file or not . This threshold is determined by factors like age, earned income, residential status.

If you’re struggling with income tax sections and provisions, not to worry. There are a lot of calculators out there to make the process clearer. You can use our income tax calculator to estimate taxes you owe .

And keep in the mind that there are tax changes every year, so this year’s tax season may be different than last year’s. If this is hard to keep track, you can always seek a CA for help.

If you don't have enough TDS deducted, you will owe Income Tax Department at the time of income tax return filing. If you have excessive deduction, you will get an income tax refund. The key is to find the right balance.

Failing to turn in a Form 12BB is a big no-no. But you could run into other issues if you don’t include the right numbers on the form. If you don’t pay enough, you might owe additional taxes later on. If you make the mistake of paying taxes too much, you’ll get that money back in the form of a tax refund once you’ve filed and verified your income tax return.