Ok, so you have received a notice u/s 143(1) and that's causing sleepless nights for you? Well, that’s what an income tax notice does to individuals. But let us tell you an interesting fact, that you might not be aware of the fact that, not all Income Tax Notices are as dreaded as they’re perceived. Some income tax notices have good news too. So you should keep calm and read the notice carefully. This guide would also be helpful for you to understand how to respond to the notice you have received?

What is Intimation u/s 143(1)?

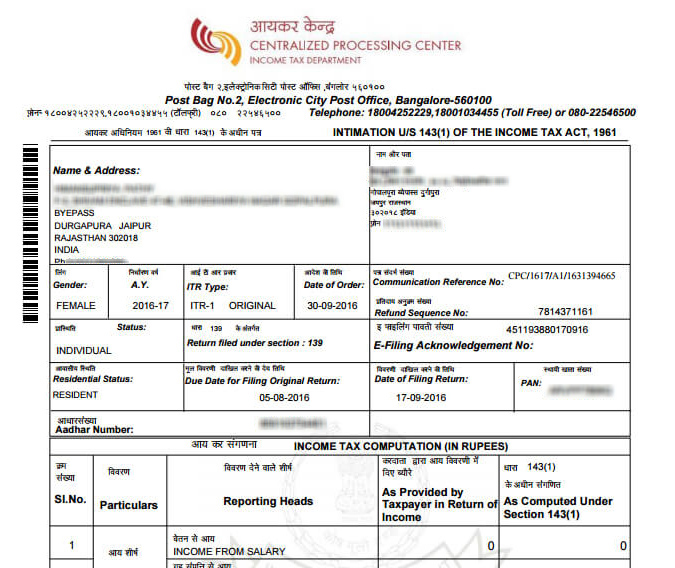

Intimation u/s 143(1) is a summary of the details which you have submitted to the tax department and the details which department has considered while processing your return. Basically, the intimation u/s 143(1) contains the following information:

- (a) Permanent Details of assessee like name, address etc

- (b) Income Tax Return filing details like acknowledgement number, filing date etc

- (c) Communication reference number

- (d) Refund sequence number

- (c) Tax Calculation as provided by you in the Return of Income

- (d) Tax as Computed under section 143(1) {i.e. As per Department}

Why is the intimation u/s 143(1) issued?

Basically, when a return is submitted to Income Tax Department, the department applies the following computerized checks as a part of its review procedure:

Arithmetical errors in the return.

- An incorrect claim, which is apparent from any information in the return. For example, if the deduction u/s 80C is claimed more than the maximum permissible deduction u/s section 80C i.e. Rs 1,50,000, the excess shall be disallowed and it will be reflected in your intimation u/s 143(1). Another example may be that rent income deducted from business income but same is not shown under Income from House Property.

- Disallowance of expenditure indicated in the audit report but not taken into account in computing the total income in the return

- Comparison of Advance Tax, Self-assessment tax and TDS etc. from 26AS.

- Addition of income appearing in Form 26AS or Form 16A or Form 16 which is not included in ITR (it is applicable for returns filed upto AY 17-18)

- Claiming the losses for carry forward to next year when return is submitted after the due date / set off of losses of previous year where return was filed after the due date.

- Whether deduction under section 10AA, 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID, 80-IE has been taken after the due date of Income Tax Return

- Calculation of Tax, Late filing fees and Interest etc.

After these checks, have been applied, then Income Tax Department Issues Intimation u/s 143(1) in the cases where there’s:

- Increase/decrease in Tax/Interest Payable, or

- Increase/decrease in Refund, or

- Adjustment that makes a change in the loss claimed

However, practically you can still receive it, even if your case does not fall in the above mentioned three criteria. It is seen practically that Intimation u/s 143(1) is sent to all taxpayers by the Income Tax Department.

Till when can I receive intimation u/s 143(1)?

Intimation u/s 143(1) can be issued only upto 1 year from the end of the financial year in which the return is filed, and not after that.

For example,

1. If you have filed your return for the year 2018-19 on 21.07.2019, then in that case, the financial year-end will be on 31st March 2020 and intimation can be issued till 1 year i.e. intimation u/s 143(1) can be issued for the FY 2018-19 only up to 31st March 2021.

2. Lastly, do not ignore this notice as you’re required to submit your response within 30 days of receipt of such notice, in case any action is required.

What should be done on receiving intimation u/s 143(1)?

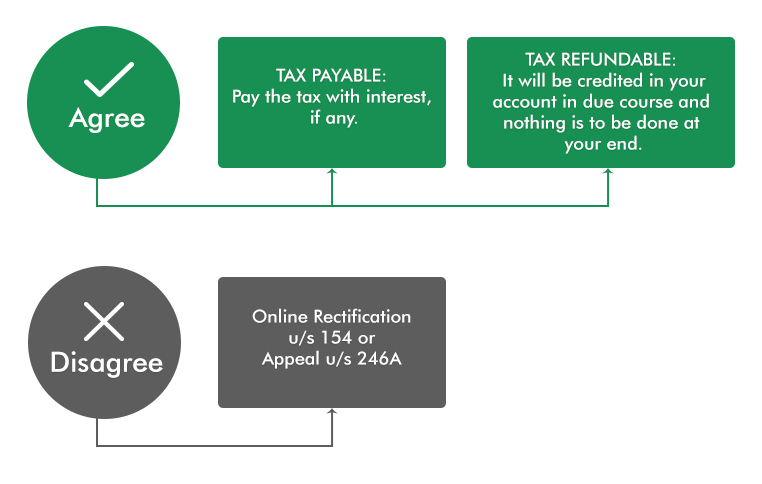

On receiving the intimation u/s 143(1), there’ll be two cases, either you’ll agree with the computation done by the department or you’ll not.

- In case you agree with the tax amount payable or amount of refund due You would be required to pay the amount of outstanding taxes or you will simply receive the amount of refund shown in the intimation u/s 143(1).

- In case you do not agree with the calculations done by income tax department You can opt to file an online request for rectification of your income-tax return under section 154 or file an appeal under section 246A.

And, if the net amount refundable or payable is zero, then you can treat the intimation received u/s 143(1) as the completion of the return filing process from the Income Tax Department for the financial year in the relation to which the return was filed.

What if no intimation is received till the expiry of one year?

In case, you do not receive any intimation till the expiry of one year from the end of the financial year in which you have filed your return, then your ITR–V acknowledgement will be deemed to be your intimation in that case. However, it is still suggested that you check online whether ITR has been processed or not by the Income Tax Department.

Did you receive tax notice? Let us help you respond to the IT Department.

- File My Tax online has expertise in responding to Income Tax Department

- Our experts would help you avoid legal consequences by assisting in responding accurately.

How is the intimation u/s 143(1) received?

These intimations are auto-generated which are sent to the Email address provided by you at the time of filing income tax returns online / mail id given at the time of registration on income tax website. The sender of these mails is Central Processing Centre (CPC) with the sender id being [email protected] as the returns are processed at CPC only.

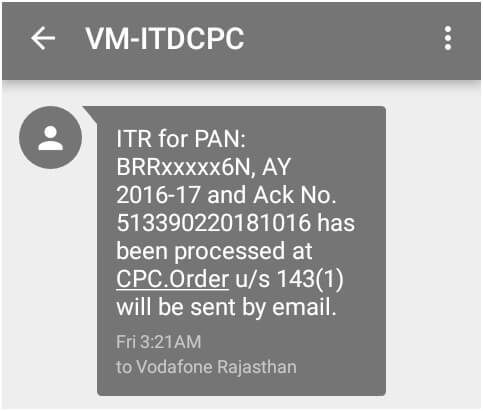

As technology is growing, so is the Income Tax Department. Now with the sending of Intimation u/s 143(1), a text message is also sent on the registered mobile number.

What is the password to open intimation u/s 143(1)?

The attachment received is a password protected file which is your PAN number in lowercase followed by your date of birth in DDMMYYYY format.

For example,Suppose your PAN is AAGRK5803P and your birth date is 2nd November, 1982, then the password to open your online intimation u/s 143(1) shall be “aagrk5803p02111982”.

How to contact the Income Tax Department?

You can contact the Income Tax Helpline/Toll-Free Number of CPC Bangalore at 1800 103 4455 or 91-80-46605200 for Income tax queries. You can easily contact them with the help of the Document Identification Number mentioned on the intimation issued to you.

How to get the Intimation u/s 143(1) again?

If you have not received your intimation on the registered mail Id or in case you are unable to find that mail again you can get your intimation u/s 143(1) again by following any of these methods:

- By downloading it from Income Tax India Official website or

- Making a request for Reissue of intimation u/s 143(1)

Let us understand both the processes one by one.

By downloading it from Income Tax India Official websiteThis facility has been newly introduced by the income tax department under which you can download the intimation for the latest years by making a successful login to your income tax India efiling account. To download the intimation

- Make login to income tax India efiling

- Click on View Returns and Forms

- Select income tax returns

- Click on the acknowledgment number for which you want to get the information and for which the ITR has been processed

- Click on intimation and the intimation in pdf attachment will download.

Making a request for Reissue of intimation u/s 143(1)

All the intimations and communications by the income tax department are served by Email and many of the time we miss checking our mailbox or accidently loose them. So, to get the copy of intimation again you can make an online request for reissue of the intimation u/s 143(1)/154. Just follow these steps :

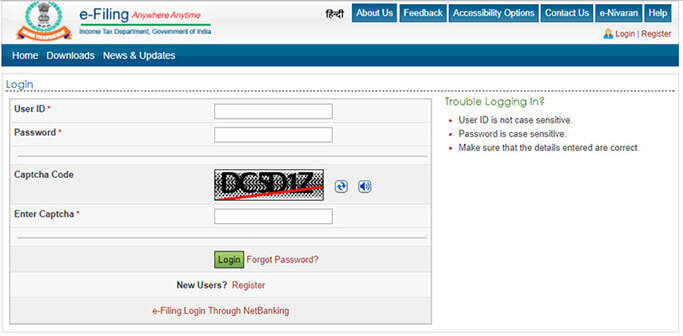

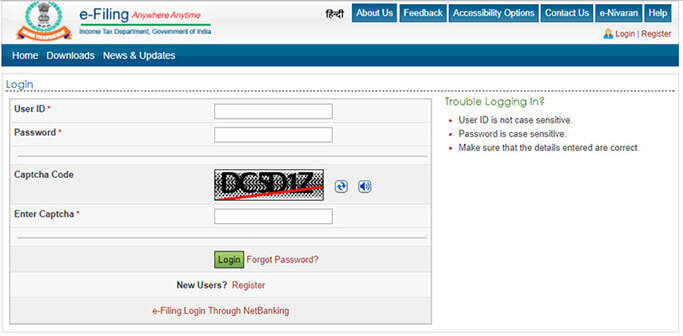

Note: Click on the below steps to see how your screen will look like while following the process.- Login to e-Filing website of the IT Department using your User ID, Password, and Captcha.

- Go to My Account tab and click on "Service Request" option from the drop-down menu on your dashboard.

- After selecting the Service request option , a new screen would appear asking the request type asking the request type - Select as New . After that select the Request category from the dropdown as intimation u/s 143(1), 154. Then click on submit.

- After that you have to fill in the required fields as displayed below depending upon your requirement and click on submit.

- After submitting the above required options and details , the intimation would be resend to your email in some days. So, keep checking your inbox.

To sum up, Intimation u/s 143(1) is a computer-generated notice which contains the final amount of tax payable or refunds to be granted, along with interest.

Check the following points when you receive an intimation u/s 143(1)

- The intimation has your name on it.

- The Intimation has document identification number

- All Incomes are considered properly under the appropriate head and Income of one head is not considered under another head or repeated elsewhere.

- The deductions you have claimed under 80C and other sections of chapter VI A are considered.

- TDS/TCS claimed, Advance Tax paid and Self-Assessment Tax paid in the computation by CPC.

- Any relief u/s 89, 90/90A/91 or any rebate claimed/ allowable is considered in the Intimation.

So, don’t get paranoid even if an intimation u/s 143(1) has been issued to you. Simply, go through the intimation, gather your supporting evidence and respond! For expert assistance of a CA and clarification, contact us at [email protected] or call +91-9660996655!

Frequently Asked Questions

Q- How do I check my 143(1) online?

Ans. It is ITD practice to send 143(1) on the registered mail. However, if you have not received you can still request for 143(1) by logging into your income tax account, then my account and request for 143(1) intimation under service request.

Q- Is intimation US 143(1) an assessment order?

Ans. No, 143(1) is not an assessment order, as it is only intimation of return getting processed.

Q- How do I open intimation u/s 143(1)?

Ans. To open intimation received under section 143(1), the password is PAN and DOB ,for example, your PAN is AAGRK5803P and your birth date is 2nd November, 1982, then the password to open your online intimation u/s 143(1) shall be “aagrk5803p02111982”

Q- How do I file rectification for intimation u/s 143(1)?

Ans.To file rectification for intimation u/s 143(1), all you have to do is to log in to your income tax portal account, then go to e-file and select rectification and choose relevant A.Y. and file.

Q- Can I use Intimation u/s 143(1) as address proof?

Ans. It can be used as proof of address.

Q- Is intimation u/s 143(1) and tax assessment order the same?

Ans. No, tax assessment order and intimation are not the same.

Q- What do I do if there is no mismatch in an intimation u/s 143(1) notice, no demand or no refund?

Ans. Then there is nothing to worry about, it means your ITR has been processed successfully.

Q- Do I need to reply to a 143(1) intimation, if I have 0 refunds and 0 tax demand, and proper sync on the taxpayer and 143(1) section columns?

Ans. No, you are not required to reply if everything is in line.

Q- Two months have passed since the e-verification of my ITR for F.Y. 2018-19, but I have not received the Intimation u/s 143(1). What should I do?

Ans. You can check your ITR status online. In case, it has been processed then you can request for reissue of intimation online and you will receive it on your mail after request. If your ITR has not been processed by the department till now then either wait for the ITR to be processed or submit a grievance. Sometimes the department takes longer to process the return.

Q- Can I revise my income tax return after receiving intimation u/s 143(1)?

Ans. you can revise your return till the end of relevant assessment year even after receiving intimation u/s 143 (1) as this intimation is not an assessment.

People also ask

- Notice U/s 148 : Assessment or Reassessment

- Notice u/s 143 (1): Intimation from Income Tax Department

- Notice u/s 139(9) : Defective Return

- Notice u/s 142(1): Inquiry Before Assessment and Regular Assessment

- Notice u/s 143(2) : Scrutiny Assessment

- Notice u/s 156 : Notice for Demand

- Notice u/s 245 : Intimation

- Notice u/s 131(1A): Validity & Response Of Summons Issued

- List of Income Tax Penalties Under the Income Tax Act

- Section 139 : Late Filings of Income Tax Returns & Due Dates