When is Notice u/s 142(1) issued?

Notice u/s 142(1) can be issued in both the cases, where you file your income tax return u/s 139 (1) and also in the case you do not file your income tax return u/s 139 (1) and time specified to file such return has been expired.

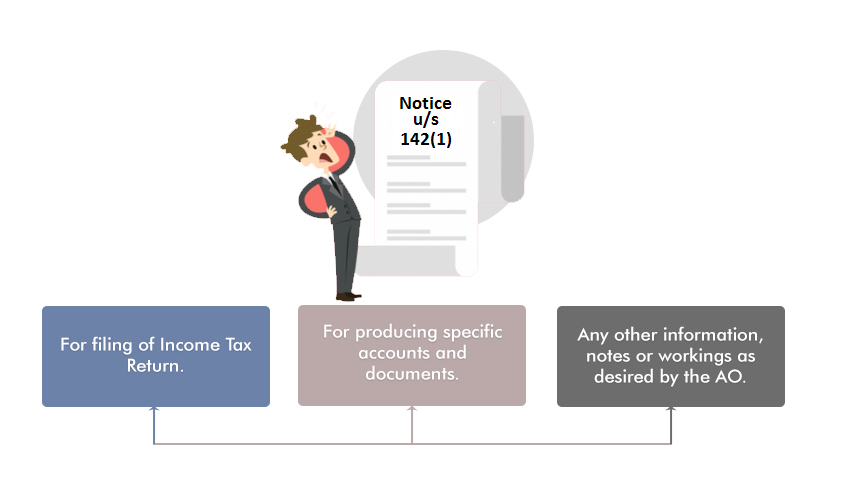

Why is Notice u/s 142(1) issued?

Notice u/s 142(1) is issued by the Income Tax Department for:

1. Filing of Income Tax Return: If you’ve not filed your return within the specified period of time or before the end of the relevant assessment year, then you might receive Notice u/s 142(1) asking you to file your return.

2. Producing specific accounts and documents: After you’ve filed your income tax return, your Assessing Officer (AO) may ask you to produce such specific accounts and documents as required by him by way of Notice u/s 142(1). For example, you might be required to produce your purchase books, sales books, or proofs of any deductions availed by you, etc.

3. Any other information, notes or workings as desired by the AO: Assessing Officer may require you to furnish in writing and in the prescribed manner the information, notes or workings on specific points as required by him which may or may not form the part of books of accounts. For example, A statement of your assets and liabilities. However, prior approval of the Joint Commissioner is required.

Did you receive tax notice? Let us help you respond to the IT Department.

- File My Tax online has expertise in responding to Income Tax Department

- Our experts would help you avoid legal consequences by assisting in responding accurately.

Non-Compliance of Notice u/s 142(1):

If you don’t comply with Notice u/s 142(1), then:

Penalty of Rs 10,000 can be imposed on you u/s 271(1) (b). However, for the A.Y. commencing on or after the 1st day of April, 2017 the penalty shall be levied in Sec 272A(1).

Your case can fall under “Best Judgement Assessment” u/s 144 where assessment will be carried out as per the best judgement of the Assessing officer on the basis of all the relevant material gathered by him.

You can be prosecuted u/s 276CC for a period of 3 months to 7 years with fine, depending upon your case. In case where you fail to produce such accounts and documents as asked by the AO on or before the date specified on the notice, then you can be prosecuted for upto 1 year with fine u/s 276D.

-

Warrant may also be issued u/s 132 for conducting search.

Frequently Asked Questions

Q- What do I do when I receive a 142(1) notice from the income tax department?

Ans. Notice under section 142(1) is issued when return has not been filed by the assessee or for producing required documents asked by the A.O. When notice is received, an assessee should file his return within the time period provided in the notice and if documents and details asked to produce and then provide the same to A.O. within the specified period.

Q- What can I expect after the submission of my ITR under section 142(1)?

Ans. After filing of ITR under section 142(1), there are changes of notice under section 143(2) for scrutiny assessment if any information is sought by A.O form the documents and information submitted by you. otherwise if the return is filed as per section , then no further action will be taken.

Q- What are the consequences if I had filed a return under Section 142(1), 153 and 148 without getting any notice?

Ans. Firstly, no return can be filed under these sections without receiving any notice and if in any case the return has been filed and the particulars are true, then there is nothing to worry and if any mistake has been made by you while filing return , then revised return can be filed under section 139(5) provided time period to file revised has not expired.

Q- Is it possible to get a wrong notice from the income tax department?

Ans. Normally, it is not possible to receive wrong notice from ITD but it may happen that PAN mentioned is wrong in notice.

People also ask

- Notice U/s 148 : Assessment or Reassessment

- Notice u/s 143 (1): Intimation from Income Tax Department

- Notice u/s 139(9) : Defective Return

- Notice u/s 142(1): Inquiry Before Assessment and Regular Assessment

- Notice u/s 143(2) : Scrutiny Assessment

- Notice u/s 156 : Notice for Demand

- Notice u/s 245 : Intimation

- Notice u/s 131(1A): Validity & Response Of Summons Issued

- List of Income Tax Penalties Under the Income Tax Act

- Section 139 : Late Filings of Income Tax Returns & Due Dates