Contents

- What is Form 26AS?

- How does Form 26AS looks like?

- Understanding Form 26 AS

- How can I view Form 26AS (Tax Credit Statement)?

- How can I view my Form 26AS with my internet banking account?

- Who can view Form 26AS through net banking facility?

- What if there is any mismatch in details with Form 26AS?

- Frequently Asked Questions

What is Form 26AS?

Form 26AS is a consolidated annual statement which is maintained by the Income Tax Department. It contains tax credit information of each Taxpayer against his PAN.

If you have paid any tax on your income or tax has been deducted from it, then Income Tax Department have these details in their Form 26AS database.

For NRIs, if they any income in India such as Interest on NRO account or any salary income and TDS has been deducted on it, then to claim tax credit and view Form 26AS, one has to register himself under Income Tax Department and should have PAN.

Details contained in Form 26 AS:- Information about Tax Deducted at Source by deductors like employers; [TDS]

- Information about Tax Collected at Source by collectors; [TCS]

- Advance tax/self-assessment tax paid by the assessee;

- Details of tax refund (if any) made by the department during the last financial year; and

- Annual Information Returns (AIR) details, mostly of high-value transactions in respect of shares, mutual funds, etc.

- Interest received from bank & others without deducting TDS in case of Form 15G/H.

- Foreign remittance information reported in Form 15CC

- Information from the Annexure-II of the last quarter's Form 24Q related to TDS on salary

- Information from other taxpayers' ITRs.

- Interest on a refund of income tax.

- Information on Form 61/61A that could be used to populate the PAN.

- Depository/Registrar and Transfer Agent report off-market transactions.

- The Registrar and Transfer Agent report information on mutual fund dividends.

- The Registrar and Transfer Agent report information regarding mutual fund purchases (RTA).

How does Form 26AS looks like?

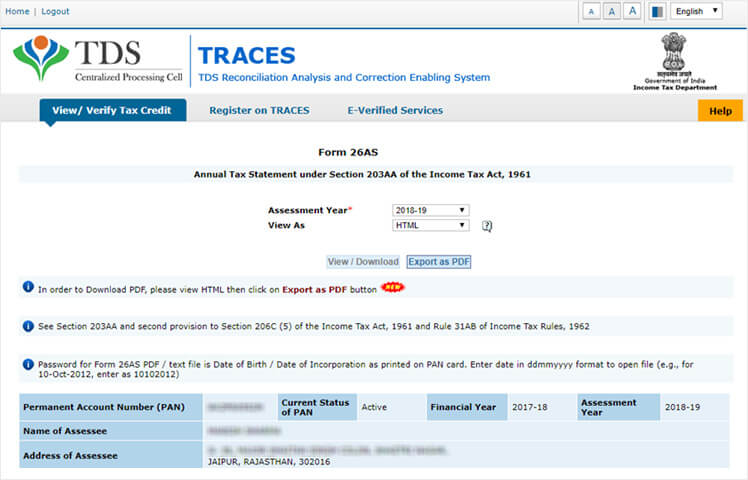

To make Form 26AS more approachable, we have attached below a screenshot of an actual traces 26AS form. Have a look at it.

Understanding Form 26 AS

Form 26AS is divided into seven parts which are explained as below:

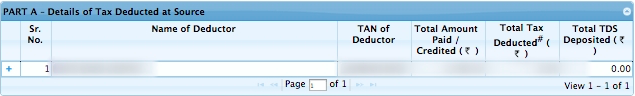

- Part A: Details of Tax Deducted at Source

It provides you the details of Tax Deducted at Source (TDS), Interest Income, Pension Income etc. and also mentions the TAN of the deductor, an amount of TDS that has been deducted and deposited with the Government, on a quarterly basis.

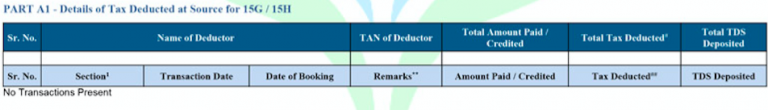

- Part A1: Details of Tax Deducted at Source for 15G/H

It has details about TDS for Form 15G/15H. In case, Form 15G/15H has not been submitted, this section will display “no transactions present”.

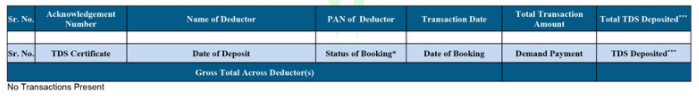

- Part A2: Details of Tax Deducted at Source on sale of immovable Property u/s 194IA

It contain details for TDS on sale of immovable property like land, u/s 194-IA

- Part A1: Details of Tax Deducted at Source for 15G/H

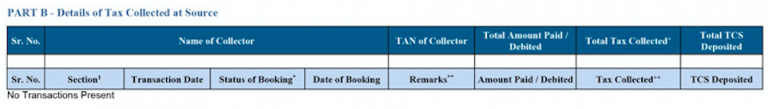

- Part B: Details of Tax Collected at Source

It contain details on Tax Collected at Source (TCS) by a seller of goods

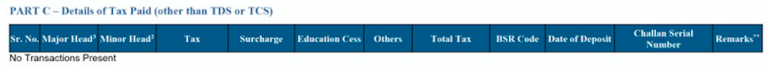

- Part C: Details of Tax Paid (other than TDS/TCS)

It contain details about tax paid other than TDS/TCS such as Advance Tax/Self-Assessment Tax, etc.

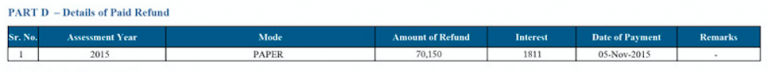

- Part D: Details of Paid Refund

It contain details about refunds (if any) which you may have received along with the mode of payment, the amount paid, interest paid and date of payment

- Part E: Details of AIR Transaction (High value transactions)

It contain details of high-value transactions like investment in property, shares or mutual funds etc. For e.g. you may have deposited a large amount of cash in your bank & this might have been reported by the bank to department or other legal authorities.

- Part F: Details of Tax Deducted on Sale of Immovable Property u/s 194IA (For Buyer of Property)

If you have purchased a property & the consideration exceeds ? 50 Lakhs. Then as per Sec 194IA, you have to deduct TDS before making payment to the seller. Part F provide details regarding such transaction.

- Part G: TDS Defaults*(Processing of Defaults)

If there is any default in processing of statement then such defaults will be mentioned in this part. But it will not show any demand raised by assessing officer.

How can I view Form 26AS (Tax Credit Statement)?

Before filing your income tax return it is advisable to always view 26 AS to check the amount of tax deposited in your account with the income tax department. One can also view my 26AS it by using internet banking facility.

It can be viewed in two ways:-

1). By login in to your income tax filing account on the Income Tax department's e-filing website https://incometaxindiaefiling.gov.in

2). Through your net banking account if your PAN is linked to your bank account.

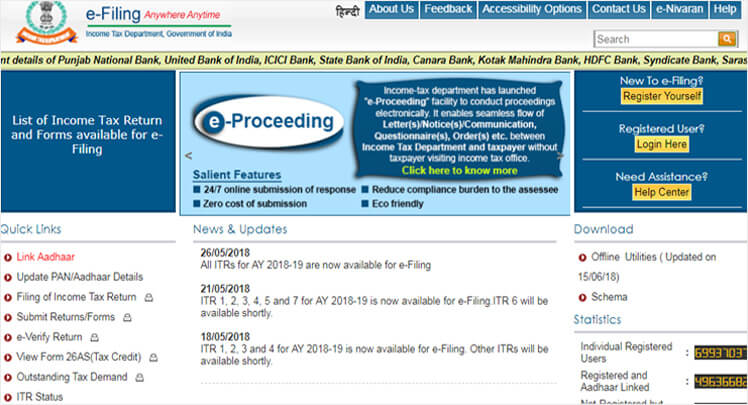

1) View Form 26AS using Income Tax website

You can download & view your income tax Form 26AS through income tax website. Simply follow the steps given below. In case you haven’t registered on income tax website, visit our page & register yourself within minutes.

- Step 1:

a) Go to e-filing website “www.incometaxindiaefilling.gov.in”

b) On top-right side, you will find “Login Here” option. Click on it.

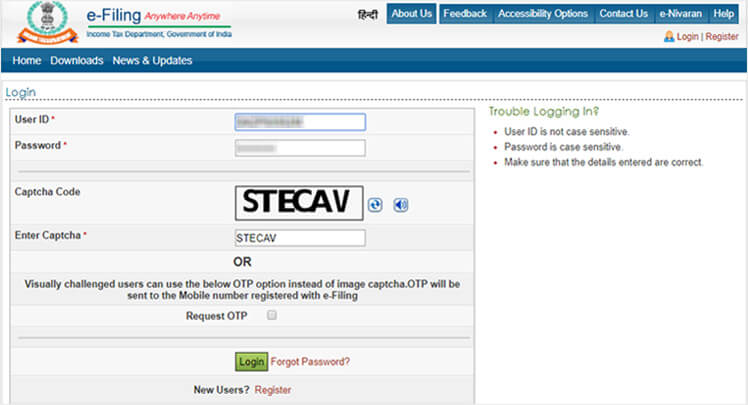

- Step 2:

a) Enter the required details like your PAN Number, Password, Date of Birth/Date of Incorporation, Captcha Code.

b) Click on Login

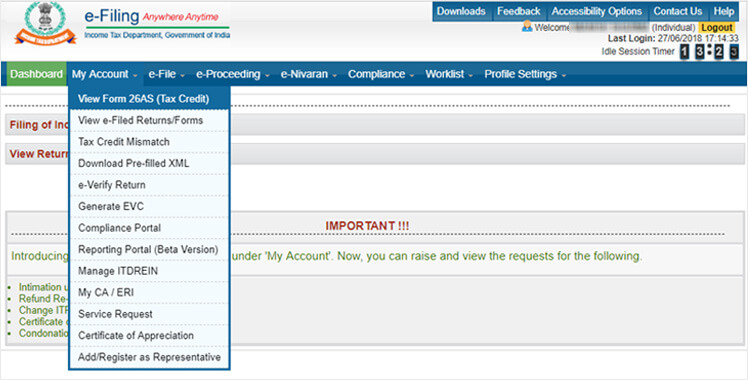

- Step 3:

a) Once you login to your account. Take cursor to “My Account” tab.

b) Click on “My Account”, you will get a drop down list.

c) From the menu select “View Form 26AS (Tax Credit)”.

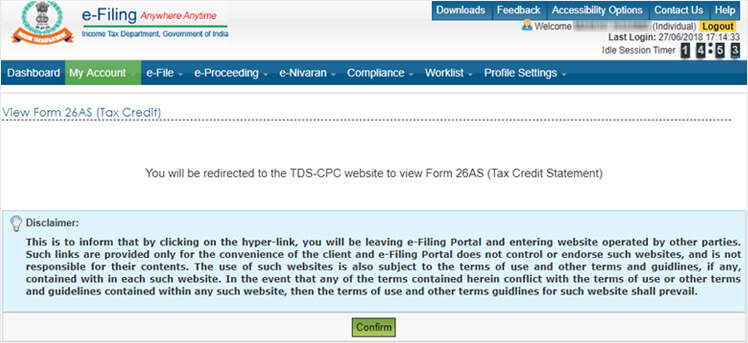

d) Click on “Confirm”. This will take you to the Traces website.

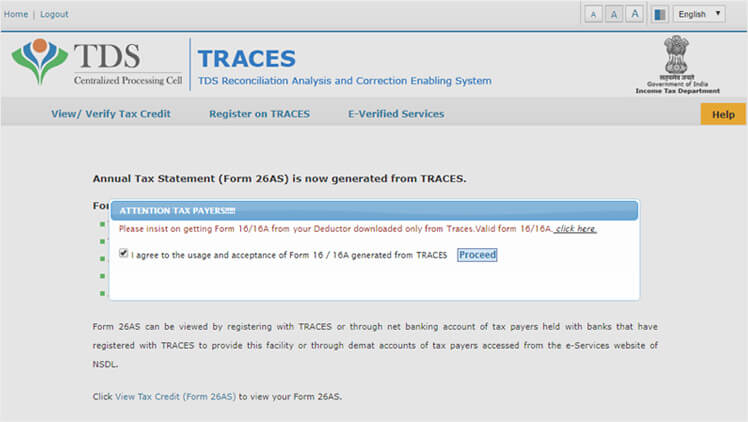

- Step 4:

Now you are at Traces Website. Select the check-box & click on “Proceed” button.

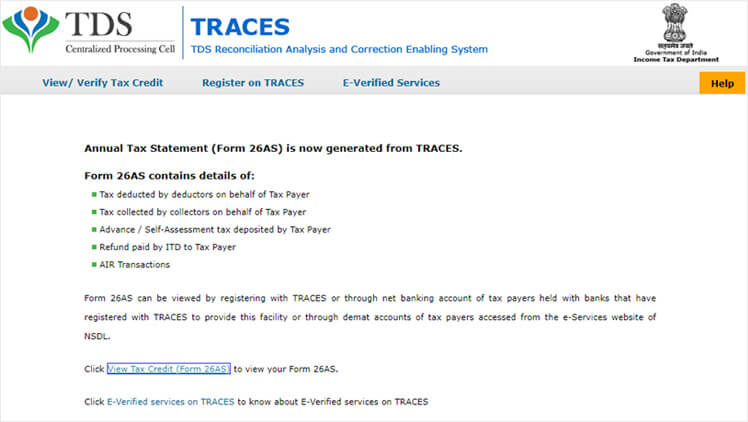

- Step 5:

Click on “View Tax Credit (Form 26AS)” to view your Form 26AS.

- Step 6:

Select “Assessment Year” and “View As” from drop down list.

If you want to see your 26AS Form online, you can view it by clicking on “View/Download” button.

If you want to download PDF file, first click on “View/ Download” and then click on “Export as PDF”.

- Step 7:

Your Form 26AS is successfully generated and you can check 26AS by opening your PDF file without any password protection. And you can verify tax details that have been paid by you or on your behalf.

2) How to View 26AS form using internet banking facility

Form 26AS can also be viewed by using internet banking facility. This facility can be availed only if you have account in banks which are approved by the Income Tax Department. We have provided a list below of approved banks for your convenience.

Which banks provide the facility of viewing Form 26AS?

- Allahabad Bank Internet Banking

- ICICI Bank 26AS

- State Bank of Travancore Net Banking

- Andhra Bank Net Banking

- IDBI Bank Ltd Net Banking

- Syndicate Bank Internet Banking

- Axis Bank Net Banking

- Indian Bank Net Banking

- The Federal Bank Net Banking

- Bank of Baroda Net Banking

- Indian Overseas Bank Net Banking

- The Karur Vysya Net Banking

- Bank of India Net Banking

- Karnataka Bank Limited Net Banking

- The Saraswat Bank

- Bank of Maharashtra Online Banking

- Kotak Net Banking

- UCO Bank Online Banking

- Canara Net Banking

- Oriental Bank Net Banking

- Union Bank Net Banking

- Central Bank Net Banking

- Punjab National Bank Net Banking

- United Bank of India Net Banking

- CitiBank India Netbanking

- State Bank of Bikaner and Jaipur Net Banking

- Vijaya Bank Net Banking

- City Union Bank Net Banking

- State Bank Of Hyderabad Net Banking

- Corporation Bank Net Banking

- State Bank Of India Net Banking

- Dena Bank Internet Banking

- State Bank of Mysore Net Banking

- HDFC Bank Net Banking Form

- State Bank of Patiala

3) View tax credit from traces site

Resident Individuals:

Step:1 Register on traces site as taxpayer

Step:2 Select “View tax credit statement”

NRIs:

Step:1 Register on traces site as taxpayer

Step:2 Select “View tax credit statement”

NRIs can view Form 26AS on www.nriservices.tdscpc.gov.in

How can I view my Form 26AS with my internet banking account?

Here are the steps to be followed for accessing your 26AS through internet banking -

Step 1 : Visit http://contents.tdscpc.gov.in/en/netbanking.html

Or Login to your bank's internet banking website using your internet banking login credentials.Step 2 : Click on the option "Tax Credit Statement" or “TRACES (26AS) Services” to view your Form 26AS.

Who can view Form 26AS through net banking facility?

This facility can be used only if you have net banking account in any of the bank's authorised by the Income Tax Department.

What if there is any mismatch in details with Form 26AS?

There may arise certain situations in which, TDS claimed by you in Income Tax Return differs from Form 26AS. The reasons for such difference can be like failure of depositing TDS on time by the deductor or not filing TDS return, quoting of wrong PAN by the deductor etc.

In this case, the A.O. will not allow you to claim credit of taxes already paid (in simple words, only TDS as mentioned in your Form 26AS will be allowed by A.O) And this will lead to payment of double taxes, penalty interest can also be levied upon you for delay in tax payment etc.

So what to do in such cases? You simply need to inform the deductor about such mistake and get it rectified immediately.

Frequently Asked Questions

Q- Can we file IT returns with discrepancy in form 26AS?

Yes, return can be filed , if details does not match with 26AS however,,be prepared with proper explanation of the difference as notice under section 143(1) is in your way.

Q- What does 'Status of Booking' mean in Form 26AS?

Status if Booking means that amount deducted by deductor and deposited in the bank is the same or not,if paid and deposited are same, then Status will be “F” meaning final.

Q- When is Form 26AS fully updated for the applicable financial year?

Since, the due date to file TDS return for the last quarter is 31st May of the following year, Form 26AS will be updated till 7th of June , if no revised return is filed.

Q- What should one do if they get a mail intimidation from the income tax department stating that there were arithmetical errors, incorrect claims, and inconsistencies with respect to an audit report/Form 26AS?

Form 26AS is a consolidated statement of all tax paid by the assessee directly or indirectly. When an intimation arrives stating arithmetical errors incorrect claims and inconsistencies, one should revise return depending on the nature of difference.

Q- Does Form 26AS take at least 6 months to get updated?

No, normally Form 26AS gets updated within a week or two.

Q- The income paid/credited showing on my 26AS statement differs from Form 16. Which one should I show in ITR 1 under 'Income from Chargeable Salaries'?

The details shown in Form 16 should be reported while filing TDS return as it is the TDS certificate from the employer and there is always a chance of Form 26AS may not have been updated

Q- Can Form 26 AS be used for a home loan instead of Form 16?

Yes, it can be used because Form 26AS can be generated earlier than Form 16 as TDS return is filed and Form 26AS gets updated within a week or so.

Q- Is professional tax reflected in form 26AS?

No, professional tax does not reflect in Form 26AS. Professional tax is state tax and FOrm 26AS does not show credit of state taxes.

Q- I have paid an Advance tax and it is not showing in form 26AS. What should I do?

If the advance tax has been paid in a period on one or two days, then there is nothing to worry as it takes 3-4 days to get processed and to reflect in Form 26AS. But the payment has been made earlier, then verify the details in the challan regarding, A.Y. and PAN, and in case everything matches, you can ask your query to income Tax Department.

Q- The income paid/credited showing on my 26AS statement is Rs. 1,25,367.44 (salary income) and on Form 16, the total income shown is Rs 1,33,209 (after deducting PF). Which one should I show in ITR 1 under 'Income from Chargeable Salaries'?

Ans. When there is a difference between Form 16 and Form 26AS, always remember Form 16 is a statement of your income and taxes while Form 26AS only provides the tax deducted .You should choose file return as per Form 16 but you should verify that amount of tax deducted as per Form 16 and Form 26As is same.

Q- How do I check whether my deducted income tax is paid to my PAN number or not?

Ans. You can always check that through your Form 26AS. All you have to do is login to your income tax portal > my account> View Tax credit> select F.Y>Download.

Q- Is professional tax reflected in form 26AS?

Ans. No, professional Tax is reflected in Form 16 and not in Form 26AS as professional tax is levied by state and not by central.

Q- How can I access a 26AS form outside India?

Ans. It can be accessed from anywhere by login into Traces.

Q- Can the income tax returns be filed using the 26AS tax credit statement without the Form 16 and payslips?

Ans. Yes, It can be, but might not be accurate.

Q- How much time will it take to reflect a tax payment in 26AS if paid directly?

Ans. It takes a minimum of 3 days to reflect in 26AS.

Q- I missed taking a copy of my Form 16 from my previous employer. Is it possible to recover the same from a tax website?

Ans.No, Form 16 can’t be recovered by employee from tax website as s/he can view Form 26AS.

Q- If the Indian income tax form 16A is correct but not matching with the 26AS, who will be responsible for it: the employee or employer?

Ans. The employee is not responsible for amount relection in Form 26AS. However, if Form 16A is correct , then there might be chances of some technical with the government side or may be employer has not paid the mount in full.

Q- I have received the following message Total TDS by Employer of PAN no. for Qtr ending Dec 31 is Rs 10,256 and cumulative TDS for FY 18-19 is Rs 24,088. View 26AS for details. What does this actually means?

Ans. TDS Deducted by employer for 3rd Qtr. is Rs. 10256 from your salary and Total TDS deducted till 3rd Qtr. is Rs. 24088.

- Income Tax Slab & Tax Rates for FY 2020-21(AY 2021-22) & FY 2019-20 (AY 2020-21)

- Income Tax Return (ITR) Filing FY 2020-21: How to File ITR Online India

- Form 16: What is Form 16? Form 16 Meaning, Format & How to Upload

- Tax Benefits on Housing Loans for Home Buyers

- Section 234F: Penalty for Late Filing of Income Tax Return